Investing in the US industrial renaissance

The US economy is amid what some are calling the ‘Industrial renaissance’. There are three secular drivers behind this renaissance - the need to rebuild America, the trend towards deglobalisation and the continued transition towards green energy.

These structural trends have been greatly accelerated by the trifecta of US spending Acts, namely, the Infrastructure Investment and Jobs Act; CHIPS & Science Act; and the Inflation Reduction Act. All three total US$1.85tn in Federal Government spending alone, representing a massive once-in-a-generation investment not seen since the 1950s.

We believe the associated projects are long in duration, high in value and economically insensitive compared to traditional non-residential projects. To give a sense of scale, a $2tn spend represents 7.5% of current US annual GDP!

What are the 3 Major Spending Acts?

1) Infrastructure Investment and Jobs Act (IIJ Act):

This bipartisan Act was signed into law in November 2021 with projects commencing in 2023. It commits $1.2 trillion of spend comprising $650bn of baseline federal investments into infrastructure already planned (roads, rail, bridges, grid, utilities etc.) and an incremental $550bn in new project spend.

2) CHIPS & Science Act (CHIPS Act):

Another $250bn bipartisan Act was passed into law in August 2022 to progress the R&D of American semiconductors and increase high-end semiconductor manufacturing capacity by the building of new plants to reduce reliance on high-end chip manufacturing overseas (Taiwan and South Korea).

3) Inflation Reduction Act (IRA):

Signed into law in August 2022, this Act focuses on climate and energy initiatives. With $400bn directed to fund a broad set of clean energy production and manufacturing products via tax credits. This policy is the most significant action Congress has taken on clean energy and climate change designed to ensure energy security.

What are the “mega projects” and their impacts on construction?

US non-residential construction activity has seen a material uplift, driven by a wave of new project starts, which began around mid-2022. The value of projects started over the last 12 months is +28% YoY and +9% YTD.

What is evident is the material increase in manufacturing construction spend as well as the commercial construction spend, albeit to a lesser extent.

The geography of mega project starts has been broad across the US with the map below highlighting projects worth over $660bn.

While there has been concern around the non-residential construction cycle given slowing economic growth, the US regional banking crisis and the office sector going through a world of pain due to work-from-home trends, it is projected by Dodge construction that the three Acts should be enough to make up the gap to grow non-residential construction starts out to at least 2025.

With the ‘Industrial renaissance’ underway, we will explore the three secular drivers which these spending Acts are accelerating.

1. Rebuilding America

America has been underinvesting in its infrastructure for decades. It is perhaps no surprise that much of the US public infrastructure is now close to, or in many cases in excess of, its useful life. The chart below shows how after a period of strong investment in the 1950’s-70s US infrastructure spend has steadily declined.

The American Society of Civil Engineers (ASCE) in their recent infrastructure report card cited 42% of US bridges are at least 50 years old and 7.5% are in poor condition.

In our recent visits to the US this underinvestment was visible. Take the main airports of two US gateway cities, Los Angeles and New York - parts of the airport are like travelling back in time. Contrast this with Singapore’s Changi airport, where it feels like you are stepping into the future. This is just one of a myriad of examples that can be observed as frequent visitors of the US.

The IIJ Act represents the largest modernisation of US infrastructure spending since the decade of 1956-1966 when the US built the Eisenhower Interstate System. This was revolutionary at its time, as it provided a vital link for connecting goods to markets and increasing mobility of people from cities, towns and rural communities.

2. Deglobalisation: Transitioning from “globalisation” to “reshoring”

After the cold war in the early 1990’s, countries across the world began to build economic partnerships to bring cross border trade in goods and services. This trend towards ‘globalisation’ has been in place over recent decades where major businesses moved supply chains further out to countries with cheaper labour costs in the main pursuit of lowering production costs along with reducing inventory levels in the supply chain from just-in-time manufacturing. This philosophy works well in a stable geopolitical environment.

However, with the election of Trump in 2017, the US began to shift its view on ‘globalisation’ in a move towards ‘deglobalisation or reshoring’ with his “America First” policy during his term from 2017-2021. Imposing tariffs on certain Chinese goods was the first step in shifting supply chains. America encouraged factories and jobs to be created onshore.

Further, the US and China’s tensions morphed into a technology war, in a battle for leadership in next generation technologies like Semiconductors, Artificial Intelligence and 5G. The US has been increasingly blocking China’s access to their developed technologies as these tensions continue to rise. Since then, China has doubled down on its efforts to “de-Americanise” its supply chains.

Then came the pandemic and the US’s reliance on China was evident for many things such as rare earths to crucial medications such as antibiotics. President Biden issued an executive order to review US supply chains for core products like chips, rare earths, medical supplies, and batteries.

Following the demand and supply shocks that resulted from the Covid pandemic, global demand was restored through 2020 as economies started to reopen. The degree of global supply chain interconnectedness and reliance thereof became obvious as companies were faced with significant supply chain bottlenecks and unable to meet demand. This exposed vulnerabilities in production with raw material shortages, severely delayed manufacturing lead times and transportation challenges. This triggered companies across the globe, including many US-based, to reconsider their supply chain strategies with many focusing efforts to migrate manufacturing back onshore.

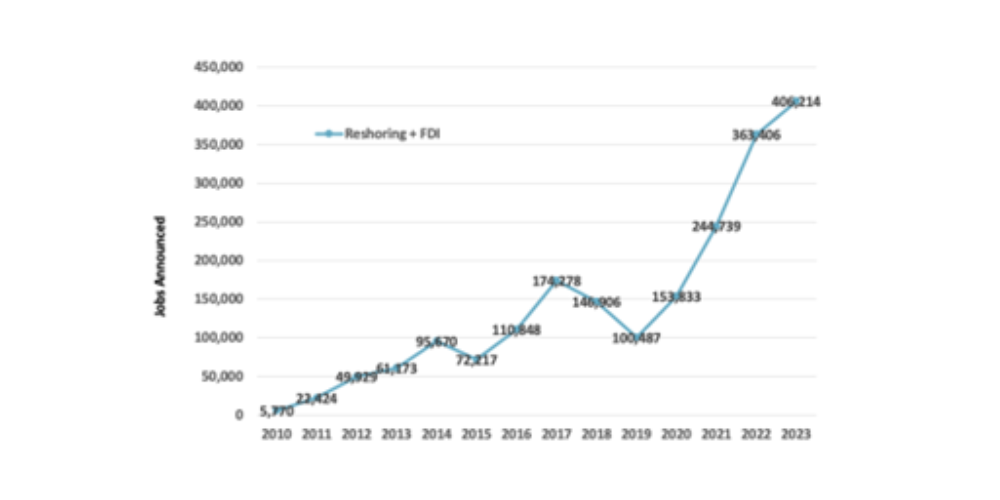

A key metric to help visualise the impact of this reshoring structural trend which commenced in 2017, is the number of jobs created per year in the US for positions that were previously held in other countries.

Manufacturing Job Announcements per Year, Reshoring + Foreign Direct Investment 2010 through to 2023

US and China technology war

Chips have emerged as the lifeblood in the modern world. One could draw analogues of chips being the new oil - a scarce resource the world needs. This was made clear during the pandemic when chip production was impacted, resulting in shortages of a wide variety of goods from smartphones to cars.

The US used to be a dominant chip manufacturer but has lost ground to China, South Korea, and Taiwan over the past 30 years.

China is investing heavily in chips as their number one industry focus in an effort to catch up to the US. The importance of this technology superiority extends not just to the economy but also to military superiority.

By enacting the CHIPS Act, the US has attracted investment in semiconductor production and innovation to the US which should help achieve progress towards multiple goals such as onshoring, maintaining technology superiority and job creation.

3. Green Energy Transition

Renewable energy component manufacturing is a key industry of the future with a growing global effort towards net zero greenhouse gas emission targets. Greater renewable energy production is in-line with the Biden administration’s clean energy and climate change goals. The IRA helps the US invest to build up local renewable energy manufacturing capacity and encourage the installation of renewable energy.

China has been doubling down to ensure it is the largest supplier to the green energy industry globally, supplying low-cost solar cells, inverters, and batteries. The US has retaliated somewhat with bans on solar cells made from the Xinjiang region which has allegedly used forced labour.

The IRA provides material support for renewable energy, battery storage, electric vehicles, and clean hydrogen. It has further widened the levelized cost of energy (LCOE) in favour of renewables over new gas-fired power plants, increasing the competitiveness of renewables. Nextera Energy estimates that new solar and wind projects inclusive of the IRA benefits are 44% and 63% respectively below the cost of new natural gas power plants per MWh of power. This provides an enduring structural tailwind for utility-scale solar installations.

The IRA has shifted up the utility-scale solar demand curve and in 2023 over half of new US electric-generating capacity was solar.

The IRA also extended the federal solar investment tax credits for residential at 30% until 2032 (from 2024) and a phase out period to 2034. This is a material long-term tailwind that should help the continued penetration of household solar in the US, which is currently only around 5%. This tax credit combined with rising utility bills, grid instability and falling costs of solar systems are compelling reasons for households to continue adopting solar.

Conclusion

Bolstered by incentives from the trifecta of US spending Acts, current legislation is catalysing investments into the US economy driving stronger competitiveness, innovation, and industrial productivity.

The secular trends observed above are setting the stage for the next era of manufacturing strength in the US and the consequential emergence of mega projects across the country. These projects are long in duration, high in value and economically insensitive compared to traditional non-residential projects, and in our view will provide an attractive tailwind to growth over the coming years.

Learn more about Northcape Capital

For more information on Northcape Capital and their funds and strategies visit their website.