Financial advisers should be considering digital assets in asset allocation decisions to ensure client portfolios have exposure to the asymmetric risk reward opportunity of blockchain technology adoption. Bitcoin has seen a material rebound in 2023 after various factors that led to last year’s drawdown abated. The record interest rate hikes that drove the bear market in long duration and growth assets are near complete and a rates cutting cycle may begin in late 2023. The excessive leverage that fueled the 2021 parabolic price action has been largely reduced within the digital asset ecosystem, along with novice risk managers and fraudulent bad actors going out of business.

Bitcoin and other digital assets prices stabilised in December 2022 as long-term holders began accumulating, and then further rallied on both macro and micro technical factors. The recent US regional bank failures and the US government QE style response increased investor interest and demand for Bitcoin as a hedge for the fiat monetary system. Longer term allocations to digital assets have had positive contributions to balanced portfolios over 3 and 5 year periods and could continue to outperform as the digitalisation thematic gains momentum. As a result, the leading digital assets have been the strongest performing sector thus far in 2023, with Bitcoin up ~75%.

Understanding the underlying technology and the potential benefits of asset digitisation will aid in determining the scope of the opportunity and appropriate exposure for clients. As blockchain technology evolves, we can expect to see a range of new digital assets being created and traded, making it a crucial area for investment strategy.

This article aims to provide financial advisers with a better understanding of the complex and often confusing elements of this nascent asset class. The article provides an overview of the digital asset ecosystem, how to access it, thoughts on the current regulatory environment, and how Trovio thinks about allocating to the space. By upskilling, advisers can help their clients make informed decisions about this sector, which is especially important as the adoption of the technology continues.

What is Blockchain?

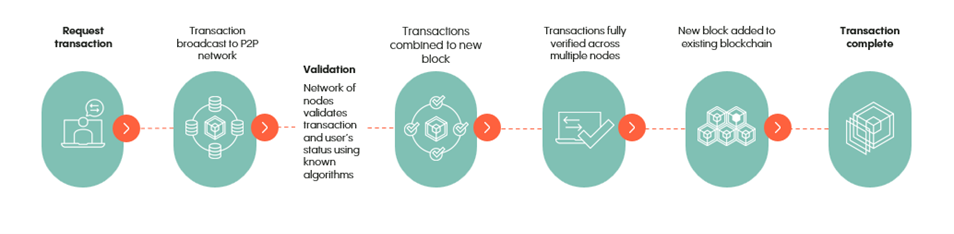

Blockchain is a type of distributed ledger technology (DLT) that involves a shared transaction ledger that is cryptographically secured and maintained by a decentralised network of nodes. This network uses consensus mechanisms to continuously verify the accuracy of the ledger, eliminating the need for trusted intermediaries. Transactions are combined into blocks that are then linked together in a chronological chain, creating a tamper-evident record that is nearly impossible to alter or manipulate. Each block contains a unique cryptographic code that ensures the integrity of the information it contains.

Consensus Mechanisms: PoW and PoS

Proof of work (PoW) and proof of stake (PoS) are two of the most common consensus mechanisms used in blockchain networks to validate transactions and maintain the integrity of the network.

- PoW (e.g. Bitcoin network) requires “miners” (purpose-built computers) to compute hash in order to add new blocks to the blockchain. The first miner to compute the hash by plugging random inputs to a mathematical function is rewarded with newly created coins and transaction fees. This incentivises miners to act in the best interests of the network. A miner would forgo any reward earned if found to be a bad actor, absorbing the loss of energy and capital expended in the process. The cost of introducing fraudulent activity outweighs the potential benefit of that activity.

- PoS (e.g. Ethereum network) requires validators to hold a certain amount of the network's cryptocurrency in order to participate in block validation. Validators are chosen at random to validate and process blocks. Validators are incentivised to act honestly by receiving a reward for validating transactions correctly, and risk having their stake “slashed” if found to be including fraudulent information. This method is more energy efficient than PoW but requires a high level of trust in the validators due to a less decentralised network of nodes than is achieved via PoW mining.

Both PoW and PoS are important concepts to understand because they provide a way for distributed networks to reach consensus and prevent fraudulent transactions without the need for central intermediaries. The choice of consensus mechanism can impact the speed, security, and energy efficiency of a blockchain network, and different networks may choose different mechanisms depending on their specific needs and goals.

What Are Digital Assets?

“Digital Assets” is a broad term that refers to any type of asset that exists in digital form and can be traded or transferred digitally. This includes cryptocurrencies, crypto-tokens, digital collectables (aka NFTs), and increasingly, tokenised real-world assets.

- Cryptocurrencies are the native assets of public blockchains. For example, Ether (ETH) is the native currency of the Ethereum blockchain and likewise, Bitcoin (BTC) is the native asset of the Bitcoin blockchain. These assets are used within their respective ecosystem to pay for transactions, often referred to as “gas fees”.

- Crypto tokens are crypto-native assets that exist entirely within blockchain infrastructure that can represent rights with real economic value and can provide a limitless range of use cases for interaction within a protocol. For example, UNI is the token of the Uniswap protocol – the largest decentralised crypto exchange – and provides holders with governance rights to vote on future Uniswap protocol changes. Protocol or exchange tokens can also accrue protocol earnings (directly or indirectly via token buybacks) or provide holders with favourable access to the respective protocol.

- Stable tokens are crypto-native assets whose value is pegged to that of another currency, commodity, or financial instrument. Stablecoins are pegged to a currency like the US dollar with other stable tokens pegged to the price of commodities such as gold. These tokens pursue price stability by maintaining reserve assets as collateral or through algorithmic formulas that aim to maintain price pegs.

As blockchain and distributed ledger technology continues to evolve and be implemented across traditional financial infrastructure, we can expect to see a growing range of digital assets being created and traded, including tokenised traditional assets such as commodities and bonds, as well as new forms of assets that leverage the technology’s immutable nature, such as decarbonised commodities.

Decentralised Finance and Smart Contracts

Decentralised Finance, or “DeFi”, is the term used to refer to decentralised applications that capture the function of traditional financial services, offering similar or improved functionality without the need for (and cost associated with) traditional intermediaries. Examples of traditional financial services most captured within DeFi include lending, broking, insurance, and various yield-generation opportunities. The ability to set the parameters (timeline, contingencies, rights, obligations etc.) of a DeFi service is enabled by the ability to create and enter smart contracts.

Smart contracts refer to the ability to program the execution of any contract on the blockchain, subject to an unlimited number of pre-agreed parameters. DeFi is a common example of a smart contract application, but this function can extend to a wide range of contract types and draw on on-chain and off-chain information to verify outcomes. Outcomes are binary based on the pre-coded logic and may not be manipulated by human interpretation or intermediaries.

The Ethereum blockchain has become the leading platform that DeFi has been developed on to date.

What are Web3 and DAOs?

Web3 refers to the way users and businesses operate in a collaborative way in a decentralised environment, whereby the development and maintenance of any application is conducted by any number of contributors on an open-source basis. For context, web1 refers to the early “read-only” version of the internet (brochures, catalogues etc.), and web2 refers to the current “read-write” user-generated content version of the internet (Facebook, Spotify etc.). Web3 refers to the idea of “read-write-own” and focuses on networks that directly reward participants for their content and data. This space is garnering interest as it provides an alternative to web2 which has generally exploited and monetised participants’ data for the benefit of big tech.

Decentralised Autonomous Organisations (“DAOs”) are entities fully governed by a set of encoded rules, relying on the contribution of participants in the decentralised ecosystem to operate automatically, without the need for any owners or employees in the traditional sense. Contributors are incentivised, often with native digital assets, to perform certain business functions, develop or maintain infrastructure, or collectively make decisions.

A Closer Look at Bitcoin

Bitcoin, the most recognised network and digital asset, is the largest by market capitalisation and currently accounts for nearly 50% of the entire crypto market cap. It is best separated from the broader “crypto” market due to its unique history and characteristics which we believe make it the best form of money created.

Released in 2008 in response to the Global Financial Crisis, Bitcoin is the world’s first engineered money, purposely designed to satisfy the principles of sound money; durability, portability, divisibility, fungibility and scarcity. For this reason, Bitcoin is said to be a hard asset and is resistant to debasement or artificial manipulation. Due to its open-source, pre-programmed nature, Bitcoin is not subject to supply-side variability in the way gold (mining production dependent on price) and fiat currencies are (28% of US dollars in circulation were printed since January 2020). Bitcoins supply is hardcoded to be 21 million coins, with the number of new coins issued per block halved every 4 years until 21 million have been produced.

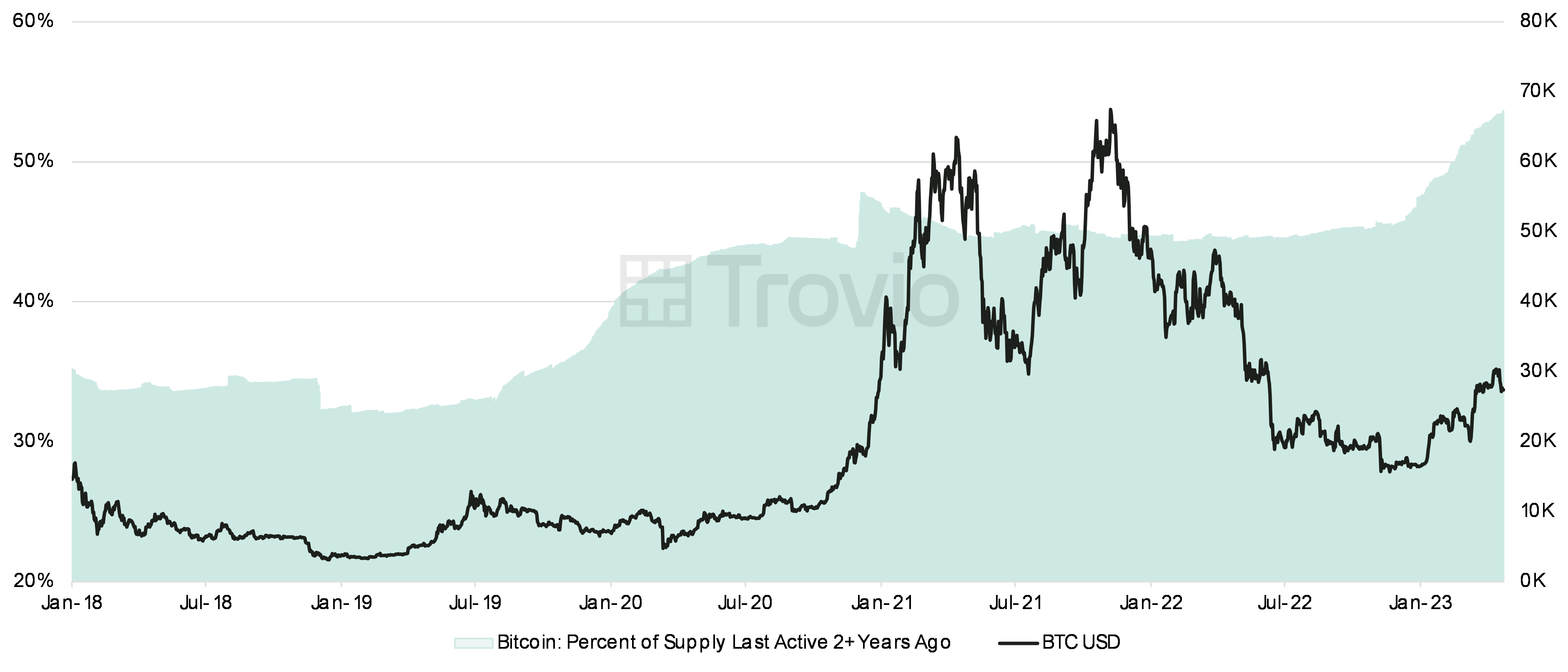

Like fiat currencies and gold, the belief that Bitcoin is money is based partially on a social construct. A portion of Bitcoin’s monetary premium is attributable to the shared social belief that the asset has future value and can be used in exchange for other goods. We continue to observe a growing number of people adopting Bitcoin as their preferred store of value, as demonstrated by the increasing number of active wallets and a growing number of long-term holders (colloquially referred to as HODLers). The below chart shows the percentage of Bitcoins supply that hasn’t moved in 2+ years – continuing to make new highs.

Trovio Charts Powered By Glassnode

Another portion of Bitcoin’s monetary premium can be derived from the vast computational power securing the network. For reference, the processing power of Bitcoin is ~80m petaflops, whilst the world’s most powerful supercomputer (Frontier) has only reached ~1,100 petaflops. The network’s total input is currently sitting above 300 exahash – one exahash equalling one quintillion hashes. Bitcoin’s hash rate and mining difficulty can be attributed to the security of the network, and the fact that hashrate continued to grow despite the significant drawdown in the underlying asset price in 2022, highlights the increasing number of mining organisations investing in the future of the network. Trovio expects this trend to persist as Bitcoin mining also becomes an accepted demand response programme, helping to balance electricity supply and demand whilst increasing grid efficiency.

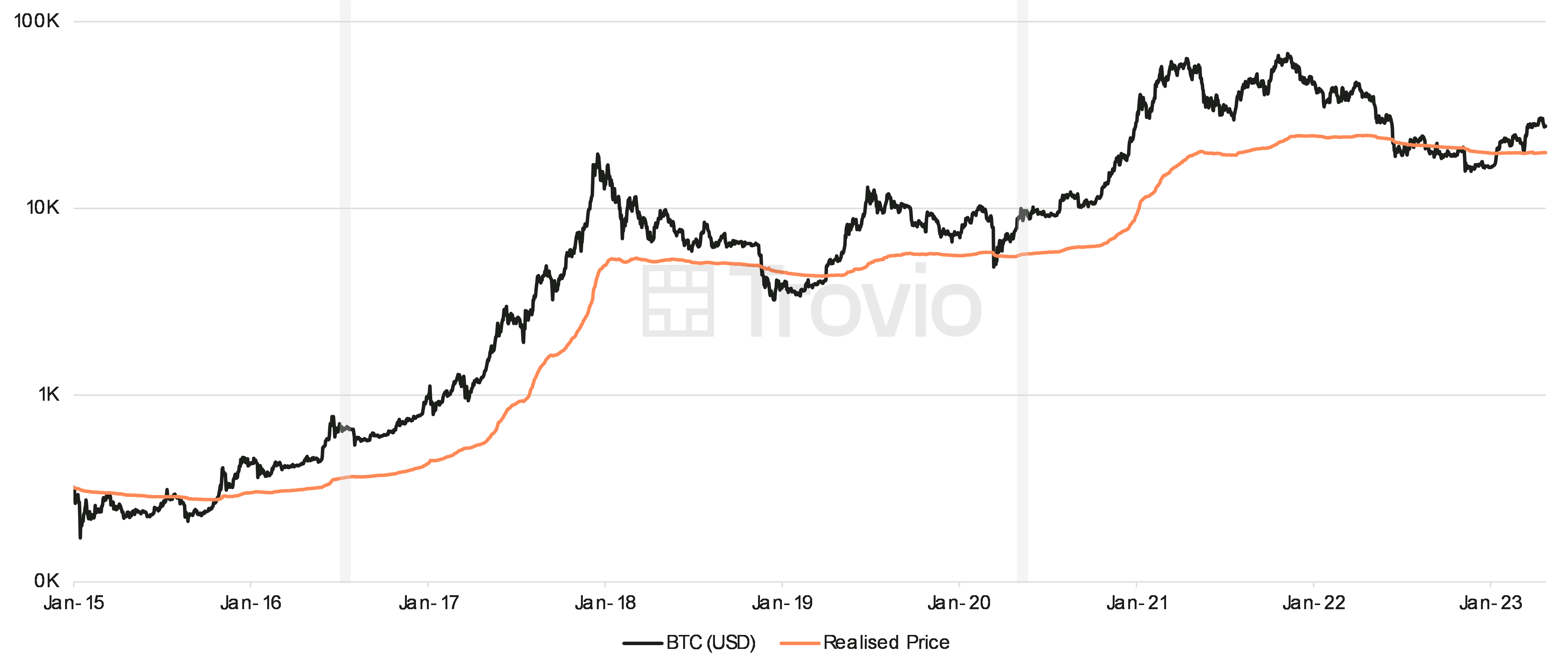

Recently, amidst the backdrop of failing banks re-highlighting Bitcoins genesis story, we have seen confluence between holder behaviour and price which further supports the investment case for Bitcoin. Arguably, Bitcoin’s continued adoption is most clearly represented by Bitcoin’s realised price. Simply put, realised price is the average cost basis for all market participants, and, as can be seen in the chart below, seems to present a long-term, consistent upward trend coinciding with the network halving cycles (marked in grey). Market price, on the other hand, has driven the better-known history of meteoric rises and devastating crashes that have spent the last decade dancing around the slow, steady ascent of realised price. As opportunity lures more participants across the knowledge chasm, galvanising fresh Bitcoin die-hards by the day, so too has capitulation cleared the decks of any speculators.

Trovio Charts Powered By Glassnode

How to access Digital Assets

In terms of accessing digital assets, there is the option for investors to invest directly themselves, invest via indirect exposure or exchange-traded funds, or invest via a managed fund. Trovio’s Digital Asset Fund leverages the firm’s technology and asset management skill set to give investors a best in class offering to gain exposure to an actively managed basket of the leading digital assets. Each option has its own pros and cons, as outlined below:

- Do It Yourself: This entails setting up an exchange or brokerage account to purchase assets, as well as setting up a custody solution to store assets.

- Pros: Relatively inexpensive, individuals (or advisers) can maintain control over the assets if held in self-custody.

- Cons: Need industry expertise to assess each asset and network and actively manage, risk leaving assets on exchange or unsuitable custody solution, or deal with technical aspects of holding crypto yourself including managing private keys.

- Listed Financial Products: Investors can gain exposure via listed “picks and shovel” companies or invest in underlying digital assets through certain Exchange Traded Funds (ETFs).

- Pros: Can access via traditional brokerage accounts, hassle-free – no technical aspect to storing assets.

- Cons: Added fees vs DIY option, crypto-exposed equities do not offer the same return profile as underlying digital assets, many ETFs gain exposure via derivatives and not the underlying asset, not an actively managed portfolio. Indirect and synthetic exposure has basis risk versus the underlying digital assets and may underperform those assets.

- Managed Funds: Invest via experienced fund managers across a range of strategies that are actively managed.

- Pros: Access to sophisticated and professionally managed strategies, access best-in-class infrastructure (exchanges, custody, administration, audit), offers a “set and forget” option for those wanting simple exposure, available via wealth platforms such as Praemium, actively risk managed by experts.

- Cons: Can often have higher fees than passive ETFs (although leading Crypto ETF’s such as GBTC have higher fees than managed funds), most offerings are only available to accredited investors, strategies can vary and need to assess manager.

Trovio Digital Asset Fund is a managed fund for wholesale investors designed to provide secure and risk managed digital asset exposure with a competitive fee structure. The fund holds digital assets in a secure custody environment and rebalances the portfolio to be fully invested when positive momentum is verified and further chooses a basket of alternative tokens based on bullish trends. The quantitative and qualitative approach also reduces exposure when bearish risk-off market environments are identified. The mandate is to deliver better risk adjusted returns for investors seeking digital asset exposure.

Holding digital assets yourself

There are also a few important areas to understand when holding your own crypto assets around public/private keys and hot/cold wallets.

- Public and Private Keys – A public and private key pairing can be thought of as your home address and keys – your public key is your home address, and your private key is your physical key which unlocks the contents of said address. Crypto private keys, usually in the form of a 24-word seed phrase, allow you to unlock/spend the assets attributed to the respective public wallet address.

- Hot and Cold Wallets - Hot storage refers to a crypto wallet that is connected to the internet, potentially making it more vulnerable to attacks given that private keys are always online. This does however make it easier to trade or spend crypto. Cold storage wallets are not connected to the internet meaning private keys are generated offline. This results in a more secure holding; however, it does come at the expense of speed and access.

The regulatory landscape

Like other tier-1 jurisdictions, Australia has been relying on its existing financial services regulations while it takes careful steps to sensibly regulate the digital asset and web3 economy, including the on-going Token Mapping exercise. Enforcement actions from ASIC have sent a clear message in consumer protection focus, right from the distribution stage of the service cycle with Design and Distribution Obligations and the Target Market Determination in this regime. Asset managers and advisors can be proactive in preparation for the expected financial product classification of digital assets, according to ASIC’s guidance in CP 343 and INFO 225, by applying for the required authorisation in regard to securities, derivatives and managed investment schemes. Trovio’s Digital Asset Fund has an Australian feeder fund which uses a very familiar trust structure that is an unregulated managed investment scheme which is available to any Australian wholesale investor under existing ASIC regulation.

The Australian government is not oblivious to the benefits that digital assets bring to market efficiency as is demonstrated by their commitment to funding the Digital Finance CRC and initiatives such as the DFCRC’s work with the Reserve Bank of Australia regarding its Central Bank Digital Currency pilot project.

Similar positive developments overseas include the soon-to-be in-force MiCA in EU, the UK’s bill to incorporate stablecoin into payment systems, Hong Kong’s upcoming virtual asset service provider licensing regime and Singapore’s exemption on certain financial services arrangements in digital assets. These jurisdictions, and several other tier 2 and 3 regulators, will attract business and talents from the US, where consumer protection is enforced at the expense of market innovation from good-practice businesses.

The United States’s digital asset regulatory approach has not been as clear as other leading financial hubs and differs within different political factions. This has been particularly apparent since the FTX failure, which damaged the crypto industry and caused embarrassment for US political circles and regulators. A resulting wave of “regulation by enforcement” by regulators such as the Securities & Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) has grabbed global media attention. Often this enforcement has been inconsistent as regulators have competed and contradicted one another in their assertions regarding the definitions and jurisdictions of different digital assets, with different regulatory board members espousing different views. The SEC views almost all digital assets as securities and argues tokens should comply with existing laws without giving further guidance when requested by digital asset firms attempting to comply. The current US approach may have the unintended consequence of pushing the digital asset industry offshore to jurisdictions with clearer frameworks and rules designed for their unique attributes, as we have seen recently with Coinbase considering a move to the UK.

The investment thesis and the role digital assets play in a portfolio

At Trovio, we believe that digital assets are evolving from early-stage investment opportunities to a high-growth asset class that requires investor consideration. We forecast a continued evolution over the next market cycle where digital assets will now be included in balanced portfolios with fixed allocations. With further regulatory clarity over the coming years, we expect a wall of pent-up institutional demand to enter the space.

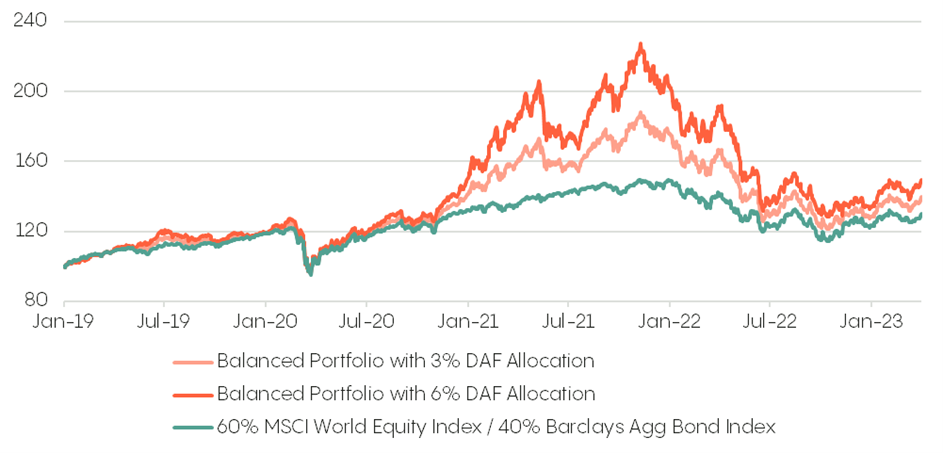

Research conducted by Citibank and MIT has examined the positive impact of a small allocation to digital assets (circa 3-6%), emphasising the importance of controlling risk and of understanding the interaction with other (traditional) assets in the portfolio. The chart below sets out the impact on the returns to a traditional 60/40 equity/bond portfolio by adding a 3% or 6% holding in a basket of the leading digital assets via the Trovio Digital Asset Fund (DAF) over the last 4 years.

The diverse universe of digital assets presents a range of investment opportunities. Bitcoin is a purpose-built hard money asset, while Ethereum is the base technology layer powering web3 and protocols like Aave that are pushing the frontier of DeFi. With the space in its nascent stages, what these opportunities have in common is the fact that network effects have so far been a large driver of price appreciation, as more and more use Bitcoin as a store of value, or use applications built on Ethereum, the respective network becomes increasingly valuable. The exponential function of these network effects may see the value of these networks (and in turn asset price) increase dramatically over the coming years, as was the case with Big Tech players such as Meta.

With that in mind, allocating to the space can be tricky given the multi-faceted aspects of the assets and networks, however we believe it is becoming increasingly clear the asset class cannot be ignored. Given the infancy and volatility of the space, we believe a systematic allocation approach such as the Trovio Digital Asset Fund, that methodically de-risks during downturns, provides the best risk-adjusted exposure to the space. With the space moving quickly in terms of service providers, tokenomics and regulation, we believe managers who possess expertise in both traditional risk management, as well as native technological aspects, are best situated to provide investors with exposure to the space.

Conclusion

Financial Advisers should recognise digital assets as a fast-emerging asset class that provides a significant opportunity for their clients. To make informed decisions and broaden investment options, it is essential for advisers to educate themselves about the underlying technology as this is a space that will inevitably have increased interest from their clients, with the CBA finding that Aussies continued to invest in the space despite the 2022 bear market (Sydney Morning Herald). The new asset class can often be confusing for investors and advisers and the nuances of the space can make access difficult. Praemium is pleased to offer access to leading digital asset fund managers in Australia and is happy to connect advisers with these sector experts should you wish to discuss the opportunity further.