Flexibility and control for your business

Praemium's market-leading software solution is the choice for leading institutions, stockbrokers and wealth management firms looking to report and administer non-custodial assets.

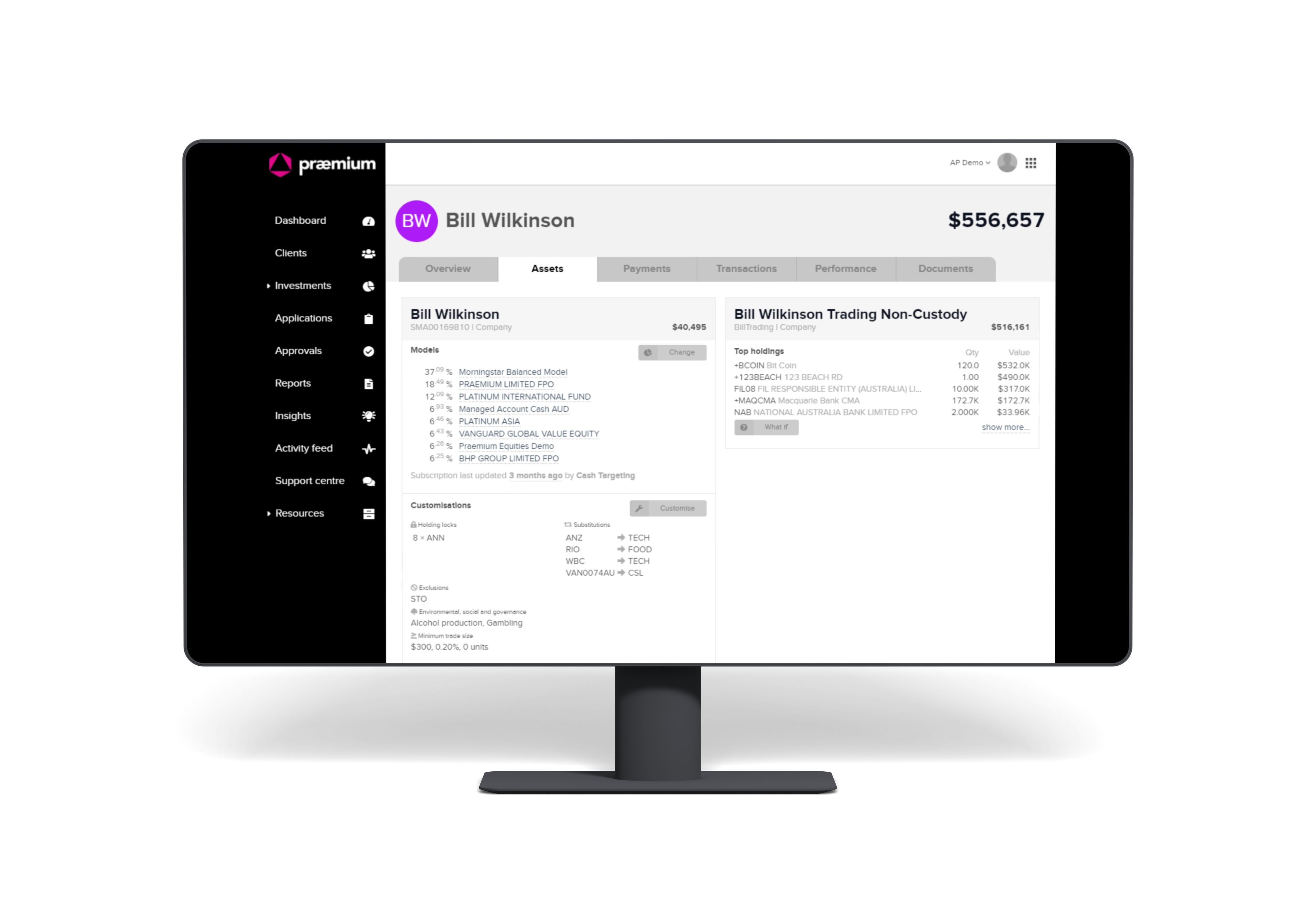

When offering a holistic wealth management experience to HNW investors, you need to be able to create a portfolio for different client segments, catering to the divergence of assets required to meet their unique investment profiles. Praemium’s software provides reporting on all ASX-listed securities, more than 4,000 international securities, bonds, managed funds, unlisted investments, CMA and Term Deposits and the ability to create your own asset types to cater for investments such as property and luxury items.

Being able to control your own external execution and even custody, you have the ultimate flexibility and control to support the variety of tailored advice strategies you develop to cater to your entire client base.

Ideal for SMSF and affluent investors

Create, administer and report on customised portfolios for your clients

Cost-effective for all

Competitive account-based pricing for full control over pricing & billing method

Market-leading reporting

Transparent, accurate, tax & investment reports with 230+ customisation options

Technology designed for your business

Our research shows that many advisers are using multiple platforms and software solutions to manage, administer and report on their clients' portfolios, with almost 60% of advisers administering over 20% of client assets off-platform*. The assets most commonly invested off-platform include; term deposits, ASX-listed shares, ETFs, Direct and Commercial property, Wholesale and Retail Managed funds and Private Equity holdings. This introduces huge inefficiencies and room for error. There is another way.

Praemium is the market leader in complex corporate actions management, performance analytics, asset allocation, tax and multi-asset investment reporting. With our software, you can bring all investments, assets and clients onto a single platform. No more juggling multiple platforms or manual spreadsheets as you can efficiently manage and report on any asset transacted externally with your choice of execution and brought together by the most comprehensive range of data feeds on any platform.

Our software is used by some of Australia's leading financial institutions and has been built to meet the exacting standards they require. Our proprietary technology ensures we can adapt and react quickly to what our clients need so that you have software that really supports your business and allows you to deliver an exceptional wealth management experience for your clients.

The key benefits of Praemium's software solution

Proprietary technology underpinned by innovation

Our technology is 100% built and owned by us. This allows us to collaborate with our clients to deliver the institutional-grade functionality they need to support their clients and their business. Our continuous improvement culture ensures we are constantly innovating and evolving our tech so that you have the latest in industry-leading innovations to give you a truly next-generation platform.

Extensive choice of data feeds to create a single information source

With Praemium you can build a core tech stack unique to your business requirements, that complements your existing in-house systems and services. With your choice of investment execution and custody, combined with one of the most comprehensive ranges of data and market indices feeds and API integrations you can aggregate all your data sources and manage all your investment assets on a single platform. Find out more about data feeds in our Developer Hub.

Total wealth solution on one platform

Praemium software provides consolidated and comprehensive reporting across a broad universe of assets. Whether your clients invest in gold, art, property or horses you can blend managed accounts, individual assets, custody and non-custody assets into a total portfolio and provide consolidated tax, performance and asset allocation reporting directly to your clients' digital portal for their total and family portfolios.

Data integrity and accuracy

We take data integrity seriously, which is why our unique transaction matching is so highly regarded by our clients. Every portfolio transaction, whether it be cash, trade or corporate action, is automatically cross-checked and reconciled against other transactions, to give you the confidence that you are providing your clients with the most accurate and up-to-date information available

Consider our team an extension of yours

We make it a priority to ensure you are getting the most out of the functionality and reaping the efficiency and cost savings our platform delivers. Our Business Implementation Team are on hand to support you and your team with initial training and ongoing training and support. Our comprehensive Help Centre is a wealth of how-to videos and articles so you can self-serve any queries you may have.

Alternatively, you can move to a fully outsourced business model and further increase efficiency by using our Administration Service. Unburden your firm from time-consuming and costly administration and leave it to our team of administration experts based in our Melbourne head office