As part of our recent research conducted with CoreData, we asked advisers to identify their top three strategies for generating alpha. The leading choice, selected by a notable 61%, was “Active management and rebalancing”

However, without the aid of software, active portfolio rebalancing can be both risky and time-consuming. It involves determining target allocations, evaluating current portfolios allocations, identifying deviations and choosing a rebalancing approach – all before considering the tax and income implications that advisers must discuss with their clients prior to executing trades.

With Praemium, help is on hand.

Our What If Trading Analysis tool for non-custodial assets, along with Model Reweighting screens for managed accounts, provides advisers with a snapshot overview of tax and income implications of any portfolio rebalance before they commit it to trade. They can also export the proposed scenarios to the adviser’s own advice documentation for full disclosure and transparency with their clients.

What If Trading Analysis

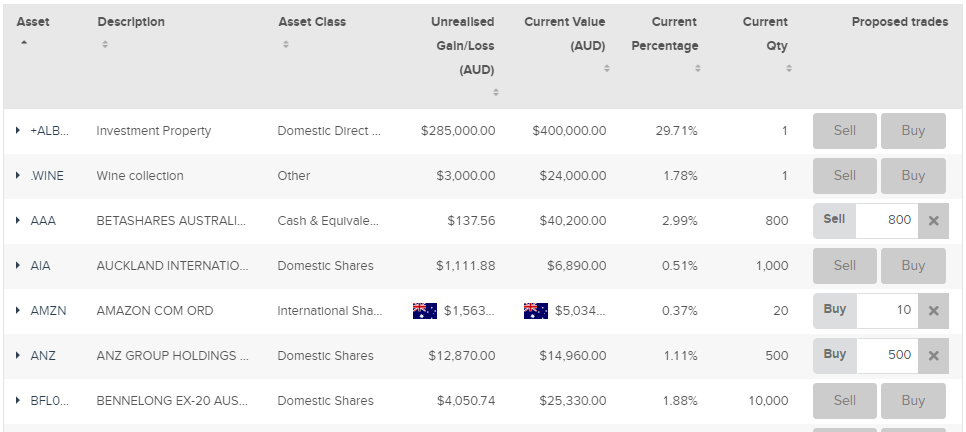

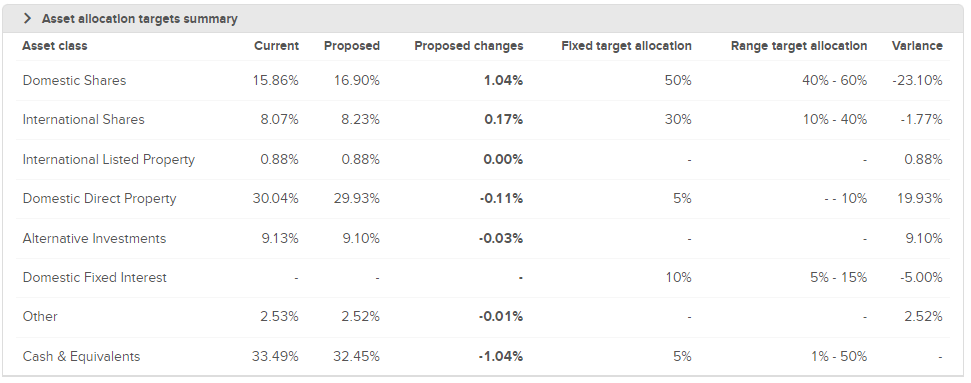

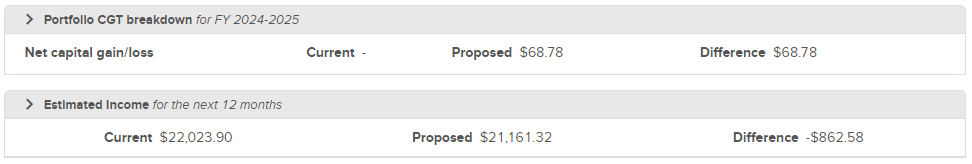

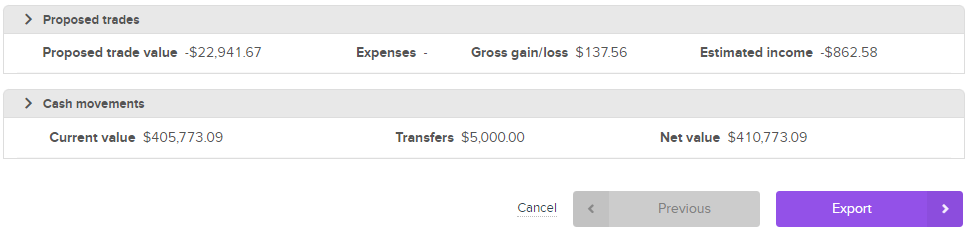

The What If Trading Analysis screen allows you to review the impact of buying and selling securities on a portfolio’s asset class allocation, capital gains tax, and estimated income.

While rebalancing can allow for tax-loss harvesting, it requires careful planning to effectively offset gains with losses.

Available from any mobile device, for any client with non-custody domestic and international assets, What If Trading Analysis is a simple, one-step process of submitting proposed trades…

To generate a full summary of impacts to the portfolio’s asset allocation...

Net impact on Capital Gains and estimated income...

And trade summary, including any proposed cash movements...

All of which, you can export and copy into your own disclosure templates.

SMA Model Reweighting

While SMAs are renowned for tax efficiency, they can also result in unexpected tax consequences. SMA rebalancing can be particularly complex when you factor in the need to keep investors informed about the portfolio's performance and the impact of any strategic adjustments.

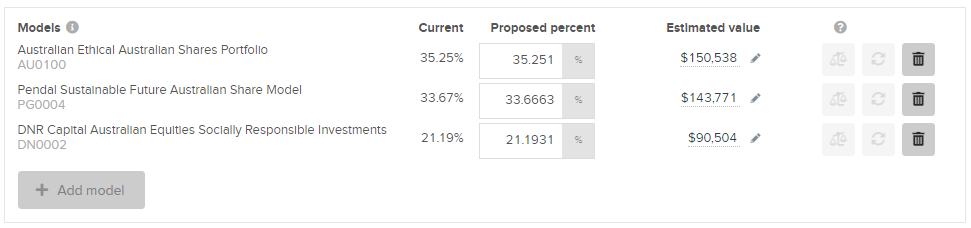

For example, this portfolio is invested in three domestic ESG models.

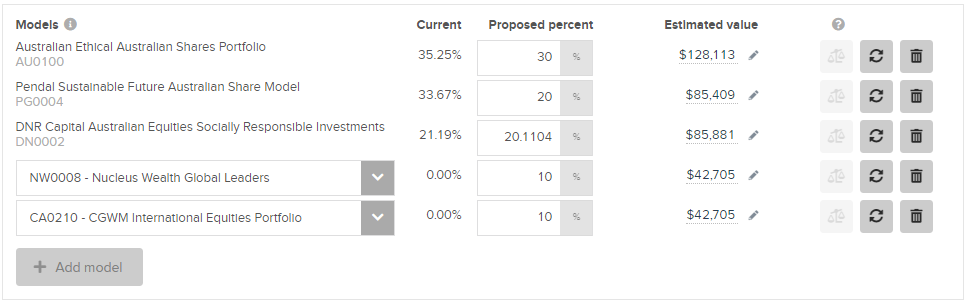

But what happens if you decide to rebalance and add some international exposure into the mix? This is a simple task on Adviser Portal’s Model Reweighting screen.

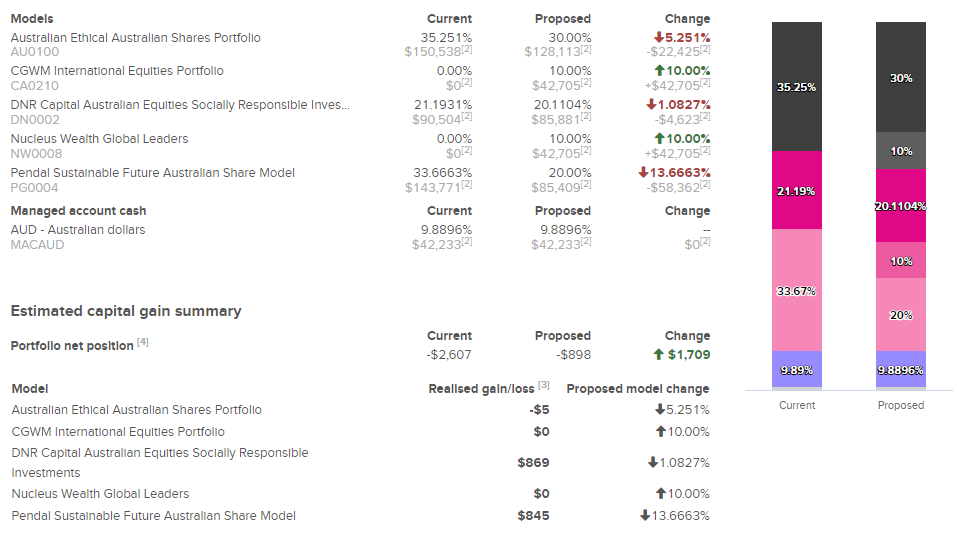

Thankfully, you can throw away the spreadsheets as Praemium’s rebalancing engine allows you to review the CGT impact of multiple complex changes in investment strategy. In this example, rebalancing the portfolio to more international assets will result in a reduction in the existing year to date capital loss.

Again, you can export the changes to facilitate full disclosure. Then once you and your client are comfortable with the proposed changes, submitting to trade is a one-step process. with rebalancing automatically occurring overnight. So, if market timing plays a role in your strategy to generate alpha, a good investment platform can help when the time is right to strike.

Active portfolio management and rebalancing with Praemium

The What If Trading Analysis and Model Reweighting screens allows advisers to tweak and review proposed changes in their hunt for alpha. While this helps with active portfolio management, it importantly provides advisers with the ability to export the changes for client review.

For more information or a demonstration, please contact our team. We’d be delighted to show you how these key features can integrate into your existing business processes.

Disclaimers

» What If Trading Analysis performs a specific calculation and the output generated may be useful in the course of forming a recommendation or decision by a qualified professional. The output generated including the result is not guaranteed, does not constitute a recommendation or opinion and does not take into consideration any person's objectives, financial situation or needs. It is not intended or designed to be used without checking the accuracy and completeness of the output generated and should not be solely relied upon in making financial or product related decisions.

» Model reweighting realised gain/loss figures are based on the latest available asset prices and model weightings. Actual trades and market execution prices may vary, and this will impact the resulting realised gain/loss. Model realised gain/loss figures do not include the impact of losses on discounting. Realised gain/loss figures are estimations derived from trades required to reach proposed model weightings. Estimation based on the Gain and Loss from resultant trades in conjunction with the current year to date realised CGT position for the Portfolio.