Smart technology and the expectation for 24/7 access it has created, has been one of the biggest drivers of changing consumer behaviour over the last decade. A recent survey by Accenture showed that 50% of clients believe their adviser should offer a digital solution. And once they start using this portal, most investors keep coming back. Our own analysis shows that 47% of investors who use Investor Portal check it every day.

While most investors use a digital solution for simple purposes such as a portfolio valuation or performance, a great digital solution can and should provide much more. Find out more about the unique features of Investor Portal that can increase an investor’s engagement with their investments.

Self-service options

Being able to self-service queries is increasingly important. Recent research suggests that 67% of customers prefer self-service over speaking to a company representative*.

Finding convenient ways to provide investors with the information they seek is key to making your portal a valuable resource for regular use.

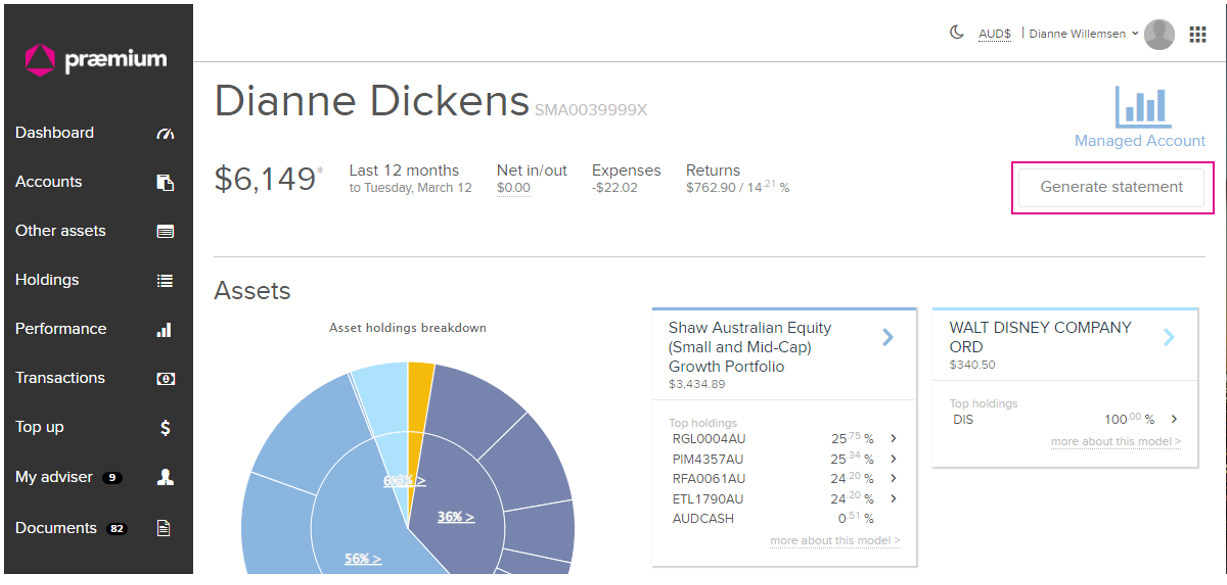

Praemium have packaged the most requested client reports into a download that only takes a single click to generate.

From within the Accounts screen in Investor Portal, your investors can click Generate Statement.

This will provide them with a single PDF report pack that contains up-to-date portfolio valuation and asset class allocation reports, and financial year-to-date income, expense and cash transaction reports.

This is not intended to replace your client report packs or taxation summaries, but provides a fast and convenient way for your clients to self-serve using their own Investor Portal.

A wealth of Super information

Many Super members are yet to take full advantage of the information provided on their Investor Portal, such as:

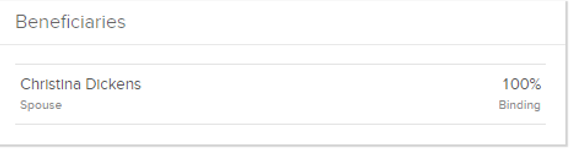

Beneficiaries

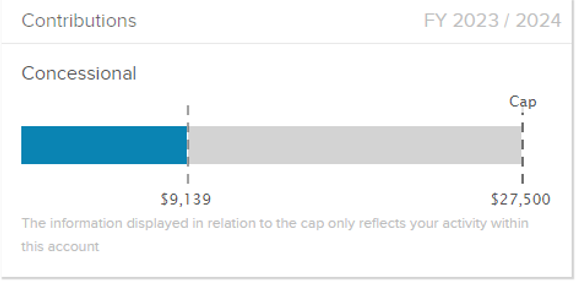

Year-to-date accumulation contributions

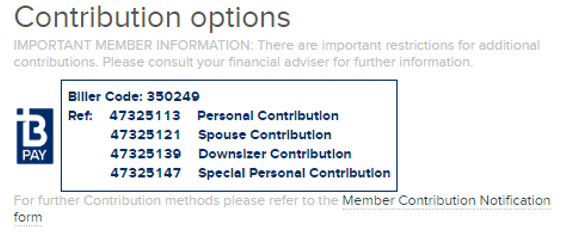

BPAY reference codes for all contribution types

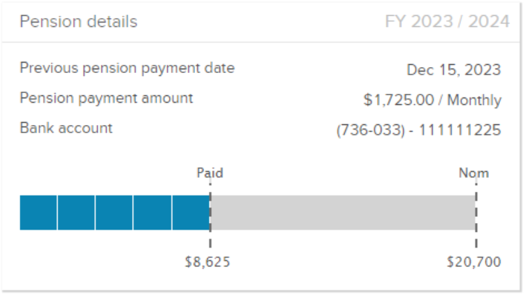

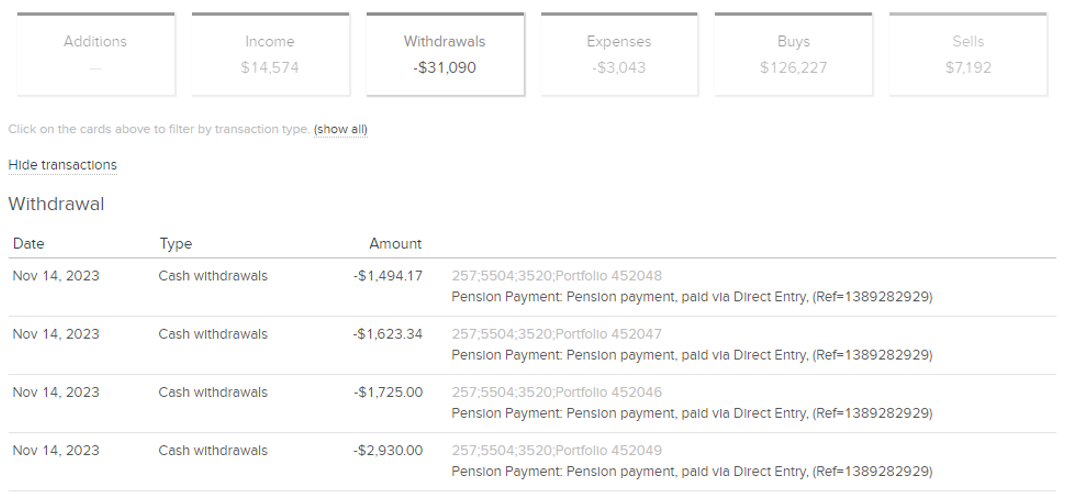

Year-to-date pension payment details

Year-to-date pension payment details

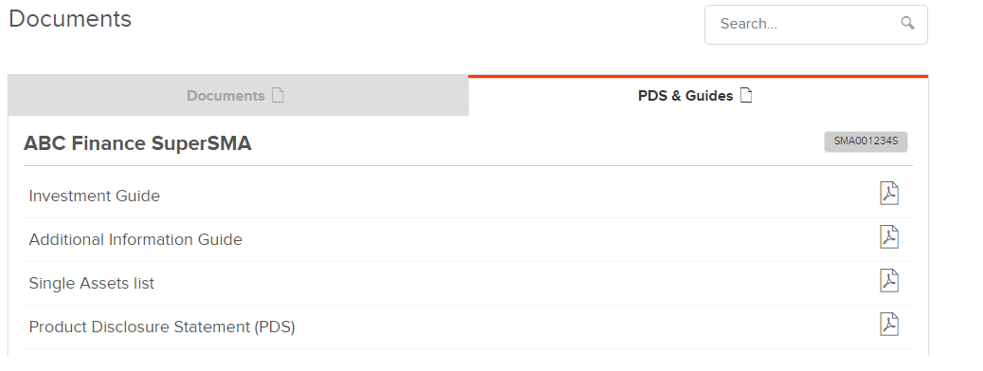

And access to important product documentation

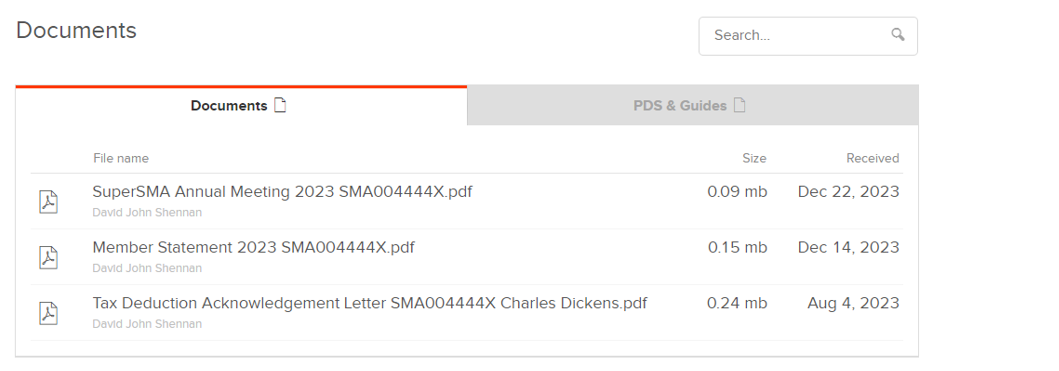

Secure sharing of sensitive information

One of the best reasons to get your clients using a web app like Investor Portal is to reduce the risk of sensitive information being accessed via email. With multi-factor authentication you can provide increased protection from cyber-attacks and phishing scams.

Not only is it less secure but email is used so extensively for the sharing of information that it has lost its effectiveness, and you have no real way of telling whether or not your client has received or opened it.

Sharing documents and forms with your clients via their Investor Portal is safe, instant, non-intrusive, and you can tell when your client has opened the document. You can rest assured that it won’t get lost in a spam folder, and if they delete it from their Investor Portal, a record is filed in your Document library in Adviser Portal so you can quickly send it to them again. What’s more you can manage application approvals and fee consents easily and efficiently as well.

Track your client’s engagement

All your investors have access to their own portal, but how many are using it? Have you set up Google Analytics or surveyed your clients?

With Praemium, you don’t have to.

Your Adviser Portal contains a client usage widget on the dashboard that, at a glance, shows how many of your clients are using Investor Portal and how frequently.

And of course, you can drill down into this data to see who is and isn’t using the portal, or even send a pre-formatted invitation directly to your client with a link to encourage them to log in and take a look around.

*A recent survey commissioned by Nuance Communications