Providing advice doesn’t just mean building an investment strategy to meet your client’s goals, but finding a meaningful and measurable reporting approach that suits each investor and delivers an enhanced level of personalisation to your investment proposition.

Praemium’s unique approach to tracking and reporting asset allocation works by matching an appropriate goals-based strategy to any account on the platform. To do this, we use Asset Allocation Strategy templates that are based on factors such as the investor’s risk tolerance, time horizon, and investment objectives

But unlike most template-driven platforms, with Praemium you can easily customise the targets to suit each client’s risk and return profile.

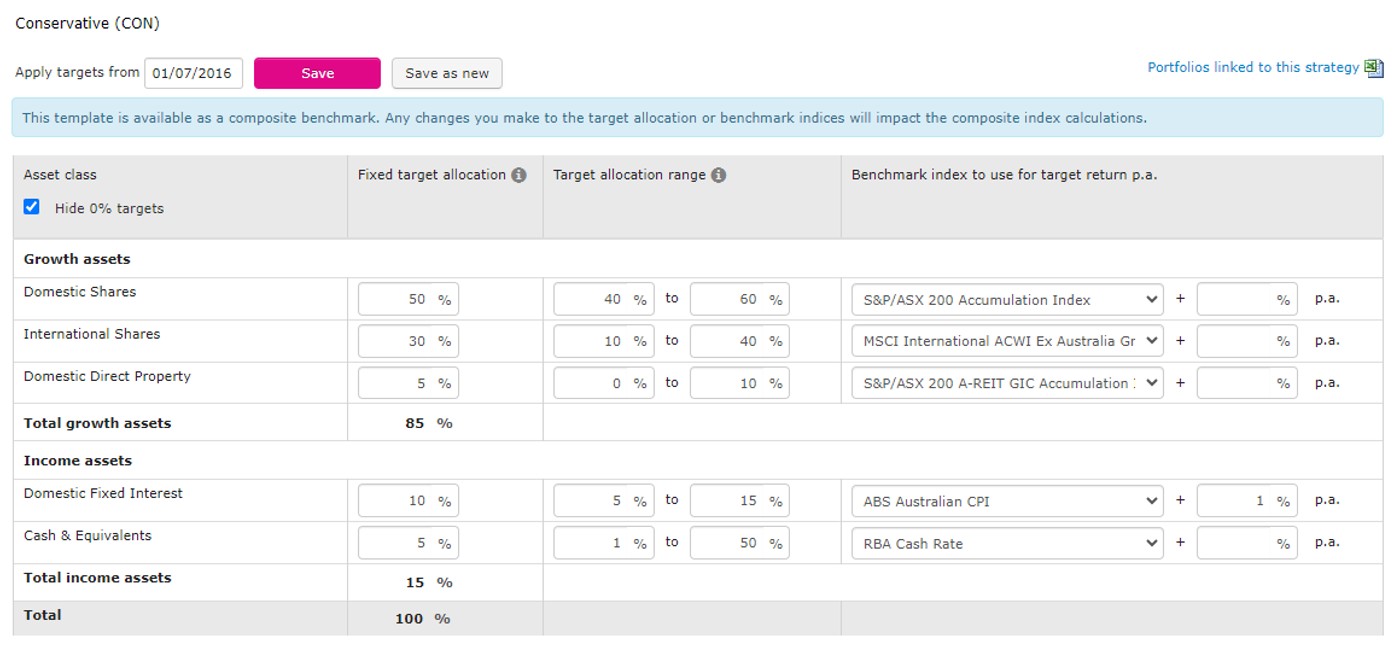

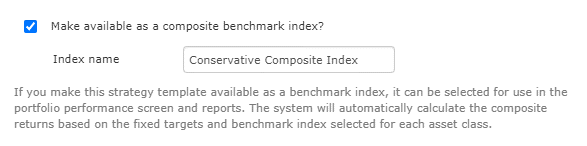

Build your own asset allocation strategy templates

With Praemium, it is super quick to create your own asset allocation strategies. As in this example, you can define both fixed targets and target allocation ranges.

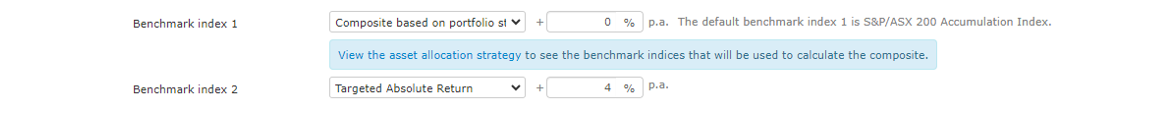

For each asset class, you can assign a benchmark. A checkbox allows you to create a new composite benchmark index based on the proportional blend of indices assigned to each asset class in your investment strategy.

Generate great allocation reports

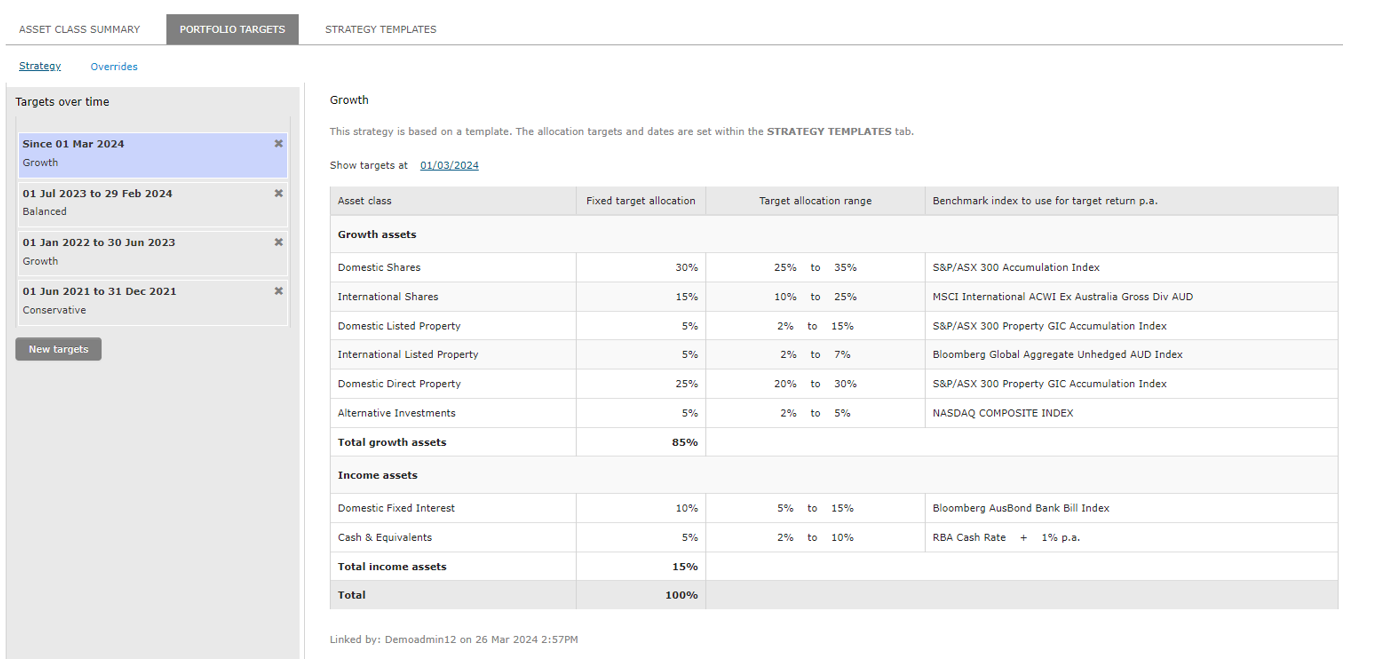

By linking a portfolio to an asset allocation strategy template, you can view all strategic changes over time.

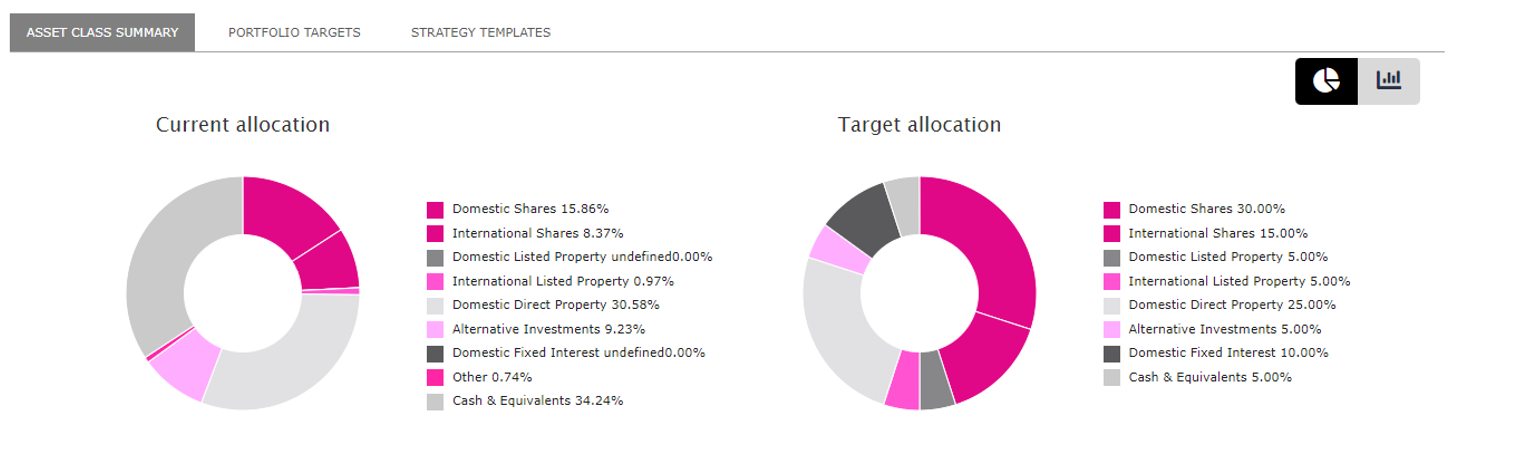

It also ensures all your asset class allocation screens and client reports are showing the current and target allocation targets:

And performance can be measured against the composite benchmark which is based on your chosen strategy. rather than a single index.

Use investment templates to rebalance portfolios to your strategy

From time to time, rebalancing a portfolio becomes necessary to maintain the desired asset allocation or level of investing risk your investors are comfortable with. And today’s generation of investors are demanding an increasingly personalised and market-responsive service. Which is why Praemium managed accounts provide you with the ability to align investment strategy templates to your asset allocation strategy templates.

One of the great advantages of this is that you can rebalance your portfolios back to their original allocation strategies overnight.

To find out more, we recommend you take a look at our recent article on Rebalancing portfolios with investment templates.