Reporting is a core part of the value proposition for most advice practices, demonstrating the value of their advice and encouraging client engagement. We’ve been working with advisers for over 20 years to create reports that present a new lens on portfolio reporting that other platforms don’t typically offer.

Traditional platform reporting focuses on valuation, performance, asset allocation and tax. And it is true that over 90% of the reports generated each year on Praemium’s reporting platform, fall within these four categories. Yet the selection of reports described below offer the opportunity to engage your clients in a new and stimulating discussion on their investment strategy.

In financial advice, there is no crystal ball. If there was, we’d all be rich. The number one reason investors seek advice is to help make financial decisions and plan for the future.

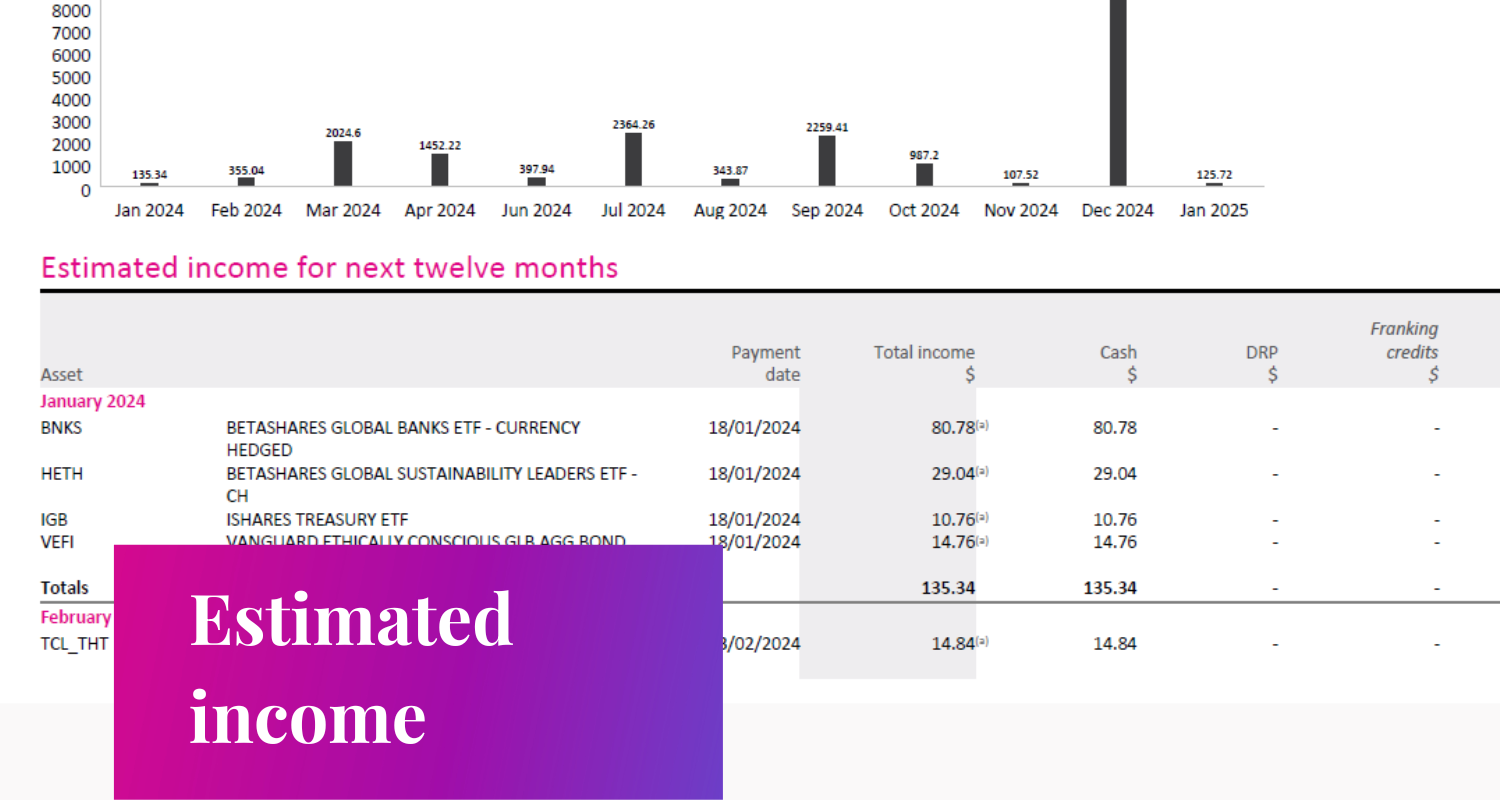

Praemium’s Estimated income report does not see into the future, but it does use patterns repeated in the past to estimate possible income from assets that are currently held in your client’s portfolio.

Starting from the day after the report generation date, the report estimates income that will be paid in the next 12 months. Which means you could use this report as a guide to help plan your client’s income stream for the year; for example, you might be showing potential pension payments, or demonstrating how their investments are estimated to pay more than the current cash rate.

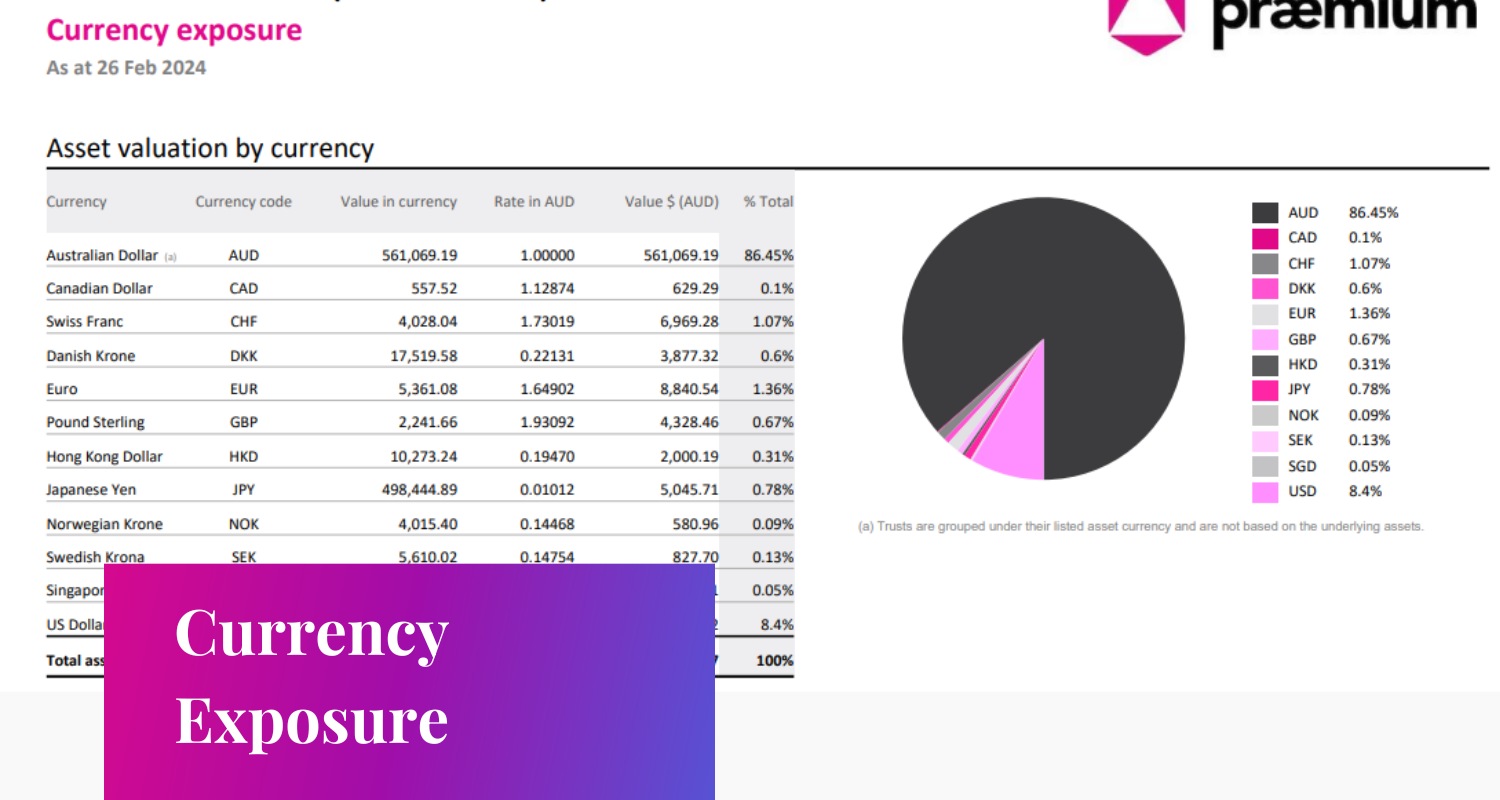

While domestic equities still comprise the vast majority of assets we see invested on the Praemium platform, international securities, including equities, funds and alternatives, have become one of the fastest growing classes.

Even if you don’t invest in forex, currency movements are likely to affect your portfolio and can have a substantial impact on returns from foreign investments.

Gains or losses will be offset or enlarged by the shift in currency values. Investing in securities that are denominated in an appreciating currency can boost total returns. However, investing in securities denominated in a depreciating currency can reduce profits.

Our Currency exposure report provides a valuation breakdown of a portfolio's assets based on their currency and can give an adviser another perspective for addressing their clients interests and concerns around international investments.

The most frequently accessed screen on our Investor Portal is our Holdings page. This screen shows the investor their assets at the security level and receives nearly double the traffic compared to the Accounts screen, which provides a model-based analysis of their holdings.

For investors with assets held in managed accounts, managed funds and ETFs, it can be confusing for them to get a clear picture of the contribution each security they hold is making towards their portfolio's total performance returns.

The Security Contribution report makes it simple to generate a report which shows individual securities, asset classes and charts, and the percentage contribution of each security in a portfolio towards the portfolio's total performance returns for a period.

Providing charts at the account level, and individual security details for all individual securities, this report can be a great addition to your client reporting suite and a useful tool for discussing portfolio performance at the more personal and the granular level that modern and increasingly financially literate investors are demanding.

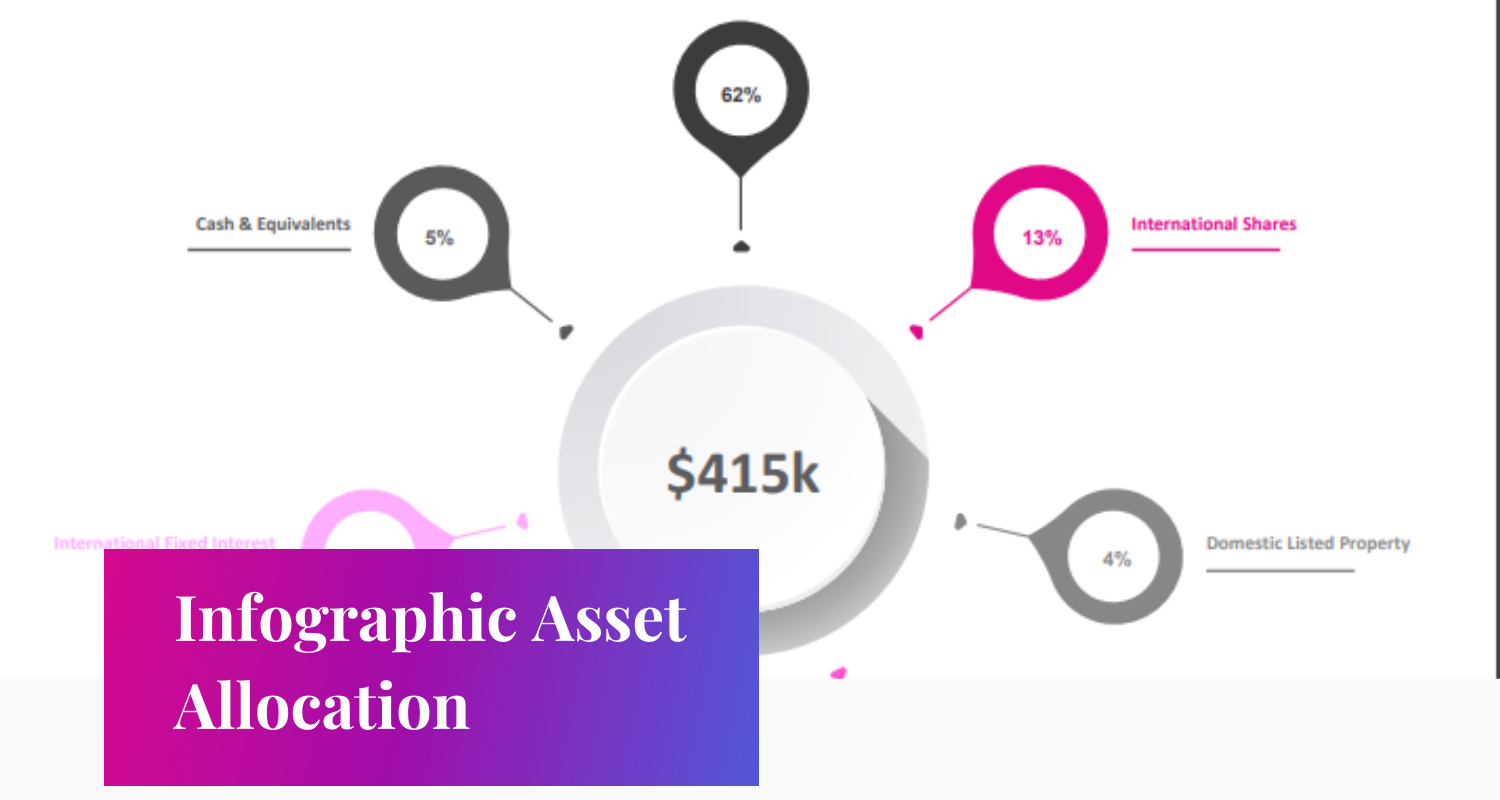

One of the most frequent requests we receive at Praemium is for new and engaging ways we can present information to your clients. As an investor, one more pie chart is not going grab my attention. That’s where we think our infographic reports can help.

The Infographic asset allocation report provides a graphical example of a portfolio's asset allocation in the colour scheme of your report branding, based on actual asset classes for the portfolio's holdings.

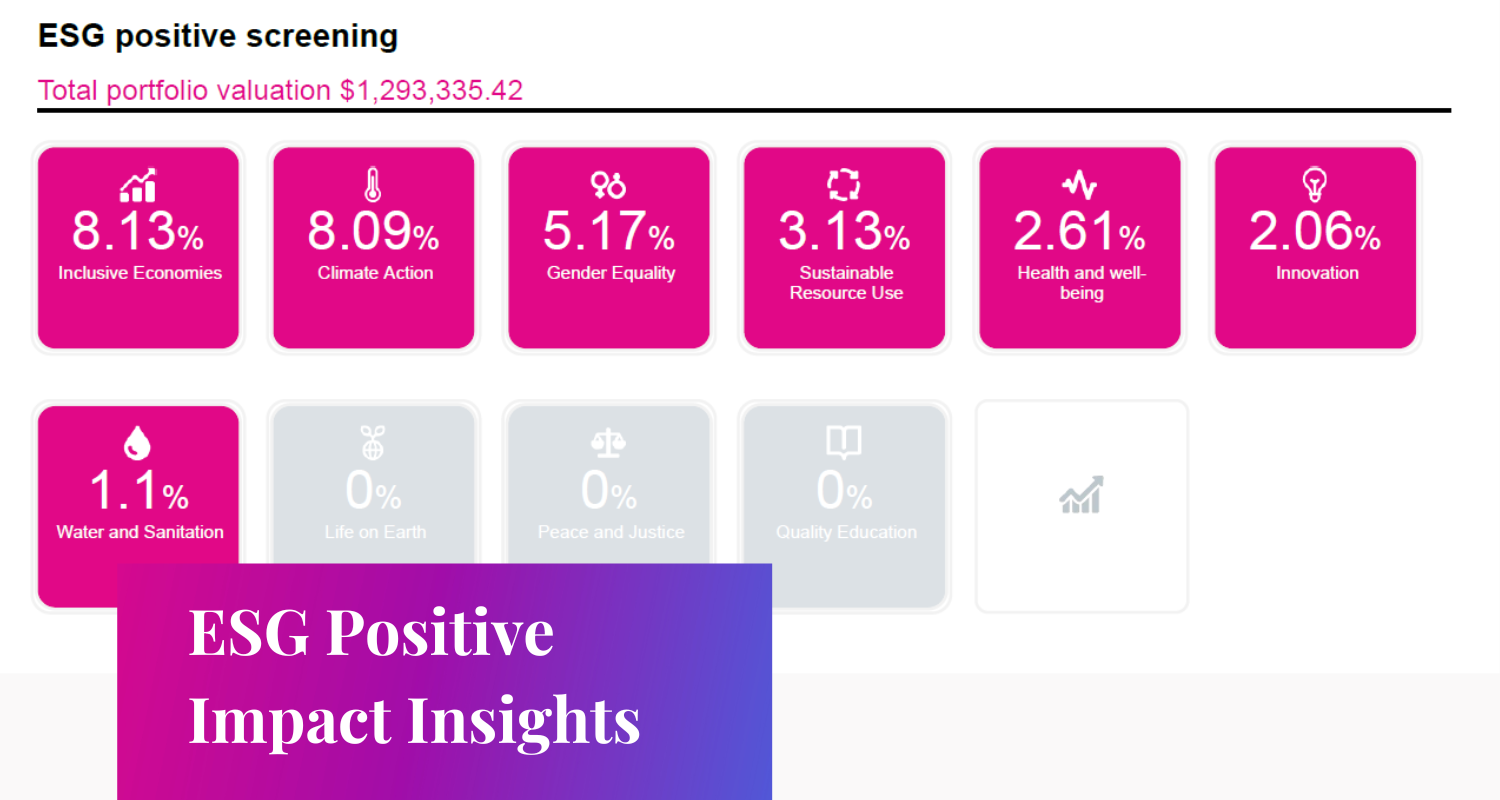

Our analysis of ESG exclusions applied on the Praemium platform reveal intriguing shifts in investor preferences. Despite global military conflicts and more frequent severe weather events, social exclusions such as alcohol, adult entertainment, tobacco and gambling are growing compared to dangerous weapons and environmental concerns.

This counter-intuitive finding could be attributed to the ready availability of impact investment options for clients with environmental concerns. But it may also suggest that, for some of your clients, there is a gap between their values and the off-the-shelf products designed to channel investment funds into specific ESG outcomes.

Advisers play a pivotal role in identifying what holds true importance to their clients and creating a bespoke solution to meet them. Starting the conversation is the first step. To help, Praemium have created the ESG insights “Positive Impact” report that gives an advice practice the ability to show how holdings they have recommended have a positive impact in terms of environmental, social and governance. It’s designed as a client discovery and education tool to prompt a meaningful ESG conversation and help uncover their unique ethical preferences.

Elevate your client reporting with the help of our team

With over 50 off-the-shelf client reports available, and the unlimited potential of our custom reporting features, finding the right report to engage and illuminate for your clients can be a challenge.

Why not give us a call or send us an email and one of our Training and Relationship team members can provide you with a quick demo of these client reports, and other engagement tools Praemium has to offer.

General report disclaimer: these reports are NOT intended to be advice

The information provided on this report is not intended to influence any person in making a decision in relation to a particular financial product, class of financial products, or any interest in either. Taxation is only one of the matters that must be considered when making a decision in relation to a financial product. However, to the extent that advice is provided on this report, it does not take into account any person's particular objectives, financial situation or needs. These should be considered to determine the appropriateness of the advice, before acting on it.