A service-oriented and cost-effective approach to keeping your portfolios rebalanced.

Portfolio rebalancing is essential for maintaining a desired asset allocation, without it, market growth could skew your target asset allocation from the agreed investment strategy exposing your client to more market risk.

A responsive approach to rebalancing focuses on re-aligning the portfolio back to the original asset mix agreed with the client. Choosing when to rebalance differs across practices and from investor to investor. While there is no one correct schedule, most advisers agree that it can be a time-consuming practice, and that a scheduled approach can be significantly less time-consuming and costly for the investor than a more market-responsive approach.

But today’s clients expect both tailored strategies and market-responsive service. Which is why Praemium is working hard to find ways to help advisers deliver this.

Investment strategy templates

Praemium’s Adviser Portal provides simple tools that deliver actionable intelligence for your business, one of which is investment strategy templates. Templates provide the ability for an investment strategy to be saved and applied over time to your client accounts.

Templates can be used to define a prescribed blend of SMA models, managed funds, individual listed securities and cash, which is matched to your clients’ investment goals and level of risk. When you apply a template; Praemium automatically re-aligns the accounts to that template, whilst retaining any exclusions or customisations. It then rebalances the portfolios overnight to match the template.

How it works

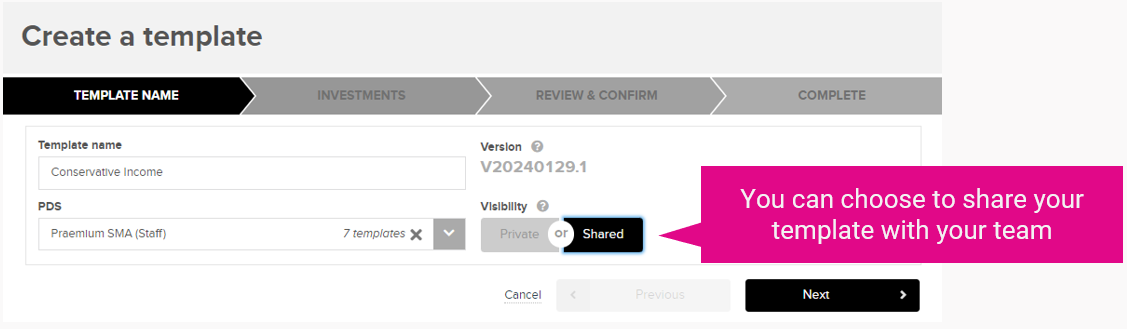

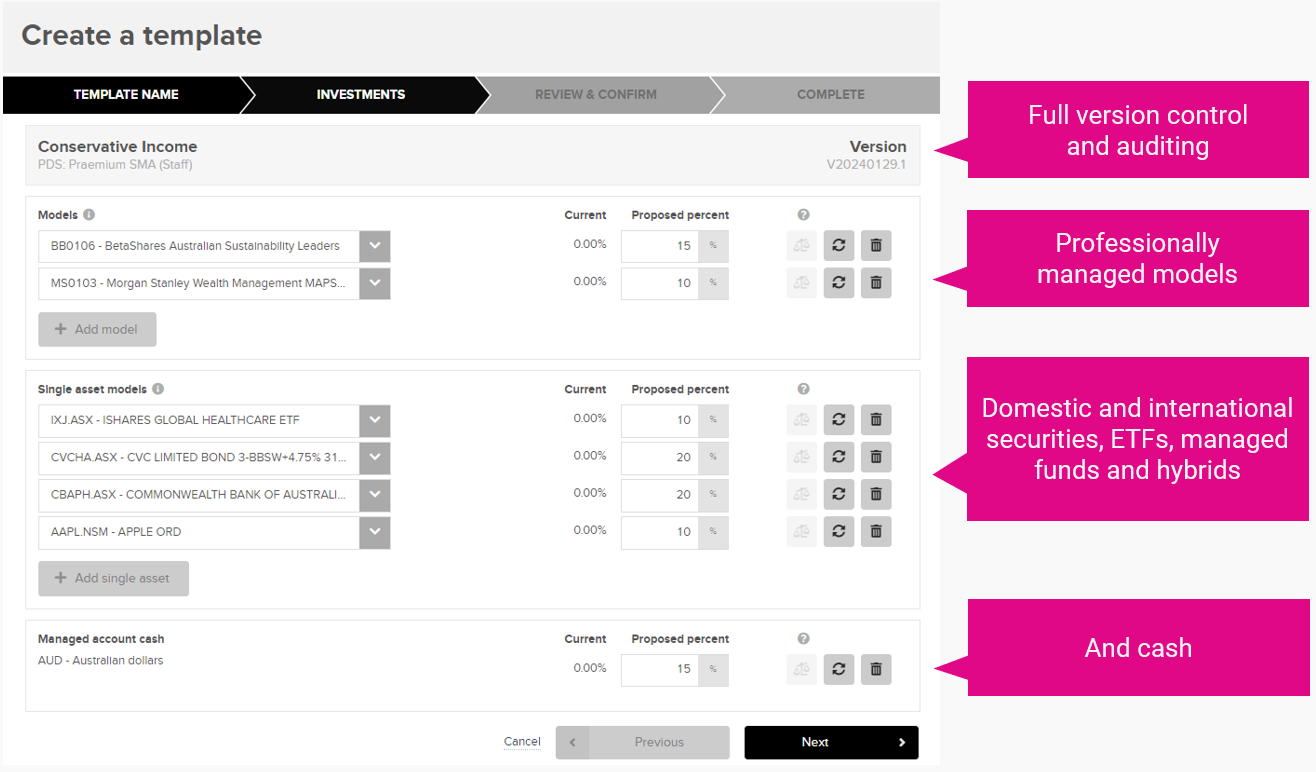

Creating a new template based on your investment strategy is straightforward in Adviser Portal.

You can choose from a market-leading selection of professionally managed models and single asset models, including international securities, ETFs and hybrids.

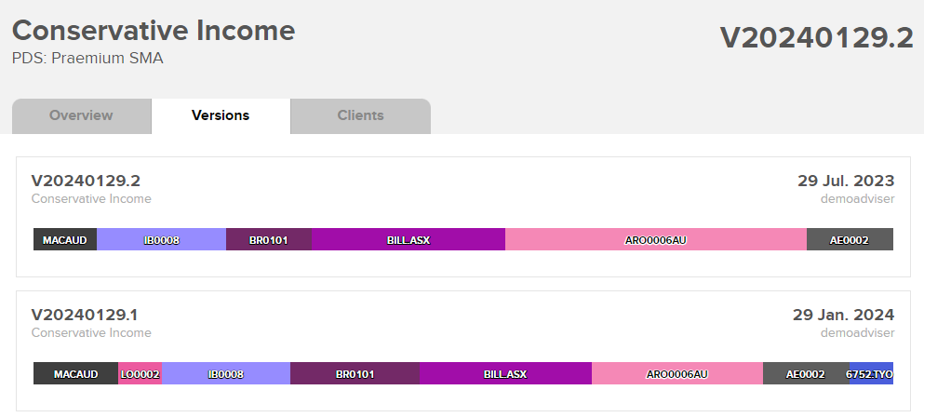

And along with full version control, you can effectively design and maintain your own investment models, which can be applied to any of your client accounts to quickly rebalance their portfolios to an agreed asset allocation strategy.

Apply a set investment strategy across multiple clients or portfolios

One of the great advantages of using templates to rebalance your portfolios is that you can revert a portfolio back to its original allocation strategy overnight. If an account has drifted from its original target asset allocation, you can pull the account back into line with your original strategy by simply reapplying the template.

If you have several clients all with the same risk tolerance and using the same investment strategy, you can re-apply the template to them all at the same time and export your changes for inclusion in your own advice documentation.

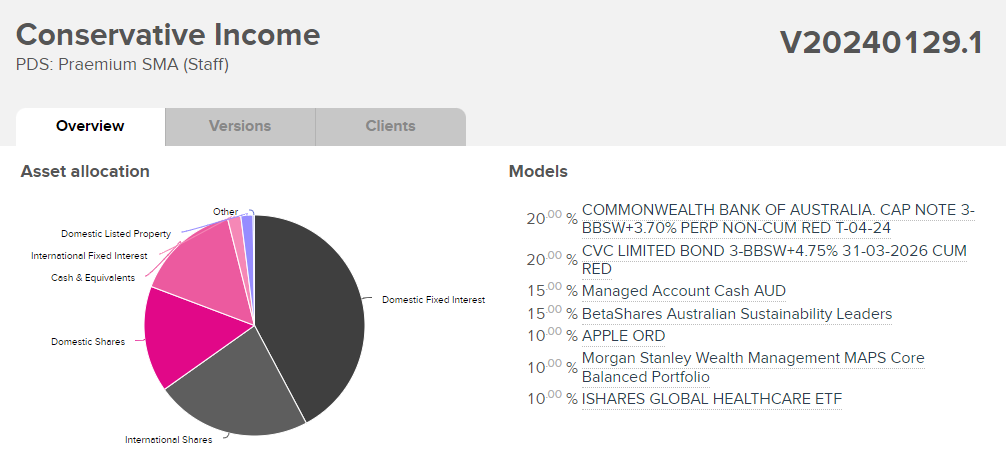

Then at any time, Adviser Portal can show you at a glance which templates contain a specific managed account model and at what weighting it is held.

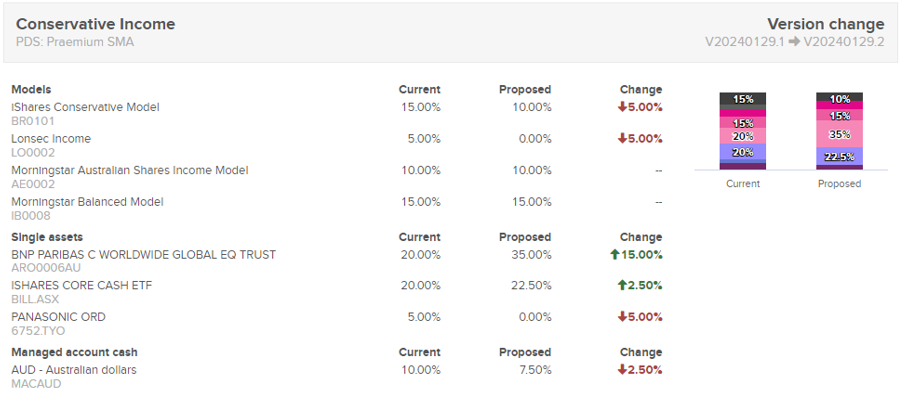

Easy version control for fast, intuitive rebalancing

When market conditions change, creating a new version of an investment template means rebalancing to a completely new strategy is intuitive and fast.

Clients linked to the previous version of a template are updated automatically. And full version control and auditing means you can roll back or view who authorised the changes directly from your mobile device.

Enhance your service

Savvy investors demanding a personalised service combined with a highly regulated environment and fluctuating markets, have made rebalancing your portfolios increasingly critical.

Demonstrating the work you are doing to realign their portfolios is yet another way you can demonstrate value. Importantly, this is simple and easy to do . By aligning your investment templates to your asset allocation strategy templates, you can generate and share client reports to show portfolio alignment to agreed investment targets for a list of portfolios at the click of a button.

If you’d like to maximise the service you offer your clients, but can’t find the time, call or email us for a quick demo or training session on how investment templates can get your client portfolios rebalanced back to their allocation targets quickly, safely and without fuss.