These businesses also tend to generate revenues far beyond those firms who simply see managed accounts as a way to reduce their RoA compliance burden. We’ve outlined a three-part process to help you make a successful and enduring transition to managed accounts and build a profitable business strategy.

- What segment of clients are you considering for Separately Managed Accounts

- What are the technology requirements and who will you partner with?

- How will you introduce Separately Managed Accounts to your clients?

1. Client segmentation

There are now a multitude of SMA models available in the market, offering passive or active investment approaches with varying degrees of investment complexity.

The managed account sector has evolved and grown quickly. Technology now plays a significant role in driving efficiencies, particularly in specialist managed account platform solutions. Practices that have the infrastructure to cater for the varying types of managed accounts and the ability to manage multiple models can best deliver scalable investment choice across their client base.

Managed accounts allow practices to cater to varying client segments and their investment requirements with no real limitations. For example, a diversified SMA model, comprising specialist ETF managers, can keep cost and complexity to a minimum, making it suitable for retail super investors. At the other end of the spectrum, advisers can cater for ultra-high-net-wealth clients using specialist models that include hybrids or international equities, or a diversified model of models, managed by an asset consultant.

In determining your client segmentation strategy, you need to ask: are managed accounts an investment solution for a particular group of your clients, or are you considering managed accounts as an advice model for the whole practice?

Every practice is unique and needs a specific strategy for how it will apply managed accounts. However, it is worth noting that those practices embracing managed accounts as a whole-of-practice model (where 75% or more clients are invested in managed accounts) are leading the way, with profit per principal 85% higher than those that are not using managed accounts at all. (Source: The real truth about managed accounts: Business Health/Praemium)

Once you have a defined approach for each of your client segments, you also have a proven, profitable strategy for attracting, retaining and servicing those segments. The next step is to assess the best technology solution to support your chosen approach.

2. What are the technology requirements and who will you partner with?

There has never been a more important time for financial planning practices in Australia to embrace the right technology and utilise solutions such as managed accounts to deliver growth and minimise risk in a business.

Financial planning practice owners are seeing significant pressure on practice valuations as outcomes from the Royal Commission put pressure on revenue streams. With the new FASEA education requirements, many planners are leaving the industry, creating an oversupply of advice firms for sale. Some business are being valued at only 1.5x recurring revenue. To minimise the risk of external factors discounting the price of a practice, owners should be looking for efficiency gains and stronger, more transparent client engagement models.

Depending on which client segmentation approach for managed accounts you intend to take, there are two factors required to ensure a successful transition to managed accounts.

- Selecting the appropriate SMA model to ensure the investment philosophy of the business is not compromised.

- Understanding the client engagement model required

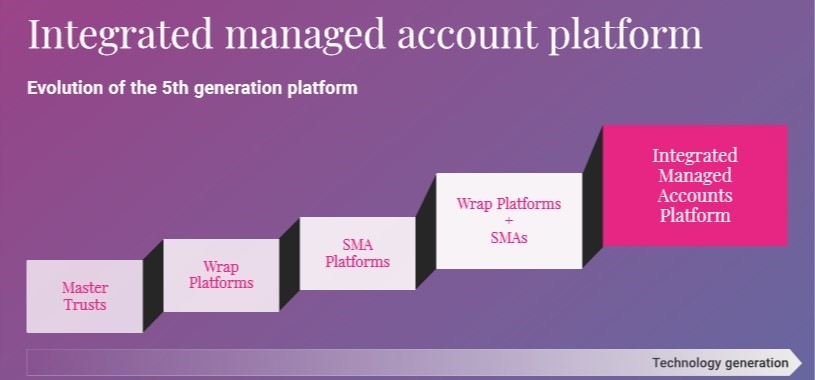

It is vital to have a much deeper understanding of the platforms offering managed account solutions than it was with a traditional Wrap or Master Trust. The platform market is in its fifth generation and those offering managed accounts have a much greater impact on investing efficiency and the cost to the end consumer than ever before.

The chosen platform needs to offer not only a suite of SMA models today, but have the ability and sophistication to continue to add models as the market, and models themselves, become more sophisticated.

Questions previously asked of fund managers and are now questions that should be asked of the platform itself:

- How does the platform trade assets?

- What assets can be traded?

- When are the assets traded to maximise market opportunities and minimise risk?

- How much does it cost to trade the assets?

In addition, we are seeing platforms focus more on client engagement than ever before. They recognise consumers are placing increased pressure on advisers to deliver a more transparent and digitally dynamic experience. Newer, nimbler platform solutions are focusing as much on the investor experience as they are the adviser experience. Ensuring a practice has a digital strategy to interact with their clients is imperative.

The managed account client engagement model differs significantly from the old annual review model and requires regular interaction with investors throughout the year. The ease with which a platform allows a practice to dynamically engage with their clients is a factor that should not be underestimated by planners. Therefore, it is important to consider;

- What reporting options are available that can cater for all aspects of SMA models?

- What functionality is available to assist in regular or ad-hoc reporting?

- How interactive and dynamic is the Investor Portal experience?

- How can I track investor usage to ensure my engagement model is being valued?

Choosing the right partner can enhance or significantly inhibit a managed account transition. The right technology has a greater impact on the underlying portfolio performance than was previously considered when selecting a platform.

Once you have defined your client segments, managed account investment strategy and chosen the platform to deliver the solution, the final step in the process is a clear implementation plan.

3.Taking a client-centric approach

When a business is transitioning to managed accounts, it is essential to consider the process from both the business and client perspective.

Business perspective - a clear strategic awareness of how and why managed accounts are being introduced into the advice model of a practice helps ensure the approach taken is enduring and will achieve expected business results.

Client perspective - it is important that the practice can clearly articulate how a managed account solution can help the client achieve their goals and enrich the client/adviser relationship. Without this, the client will be left confused or at best underwhelmed by the change.

Prioritising the client in the transition is key to its success. It’s not uncommon for practice principals and planners to internalise change and adopt a ‘what’s in it for me?’ approach. Focusing on the business benefits — that is, reduced compliance requirements and greater scale efficiencies — means the benefits to the client become secondary.

Those practices that take the time to truly consider the introduction of managed accounts from a client perspective and develop a defined set of messages will have a significantly smoother transition.

Read the next article in this series.

Introducing managed accounts to your clients

In making the transition to managed accounts you need to take your clients on the journey with you. Surprisingly the roll-out program is often missed in the planning process. So what do you need to consider?