Unifying Your Information for Better Insights and Efficiency

The process of combining information from different sources into a unified view has become a powerful tool for businesses in today’s data-driven world.

Importantly for today’s sophisticated investors, Praemium facilitates a broad range of external custodial and non-custodial transaction data feeds covering domestic and international listed and unlisted investments. This supports integrated portfolio management by enabling advisers and investors to connect all their wealth into one cohesive platform.

By providing seamless access to consistent and accurate data, across all asset classes, Praemium’s integration capability delivers numerous benefits that enhance decision-making, operational efficiency, and overall business performance.

Benefits

- Improved decision making with real time analytics

- Automated processes eliminate the need for manual data entry

- Reduced redundancy and duplication

- Increased agility lets you quickly adapt to trends or customer needs

- Accurate data reduces risk by helping to identify potential issues before they escalate

- Cloud-based integration solutions allow you to scale with business growth

Driving efficiencies with superior technology

Cash is always up to date and reconciled

Praemium's bank transaction feeds and powerful cash transaction matching mean your client's portfolio is always in sync with their bank trading accounts.

And our cash book's unique ability to remember regular deposits and withdrawals based on simple bank transaction notes makes automating reconciliation a breeze.

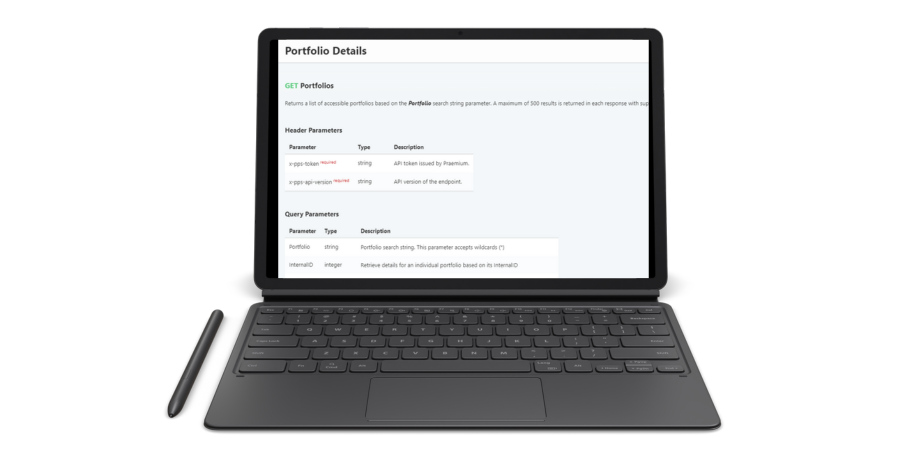

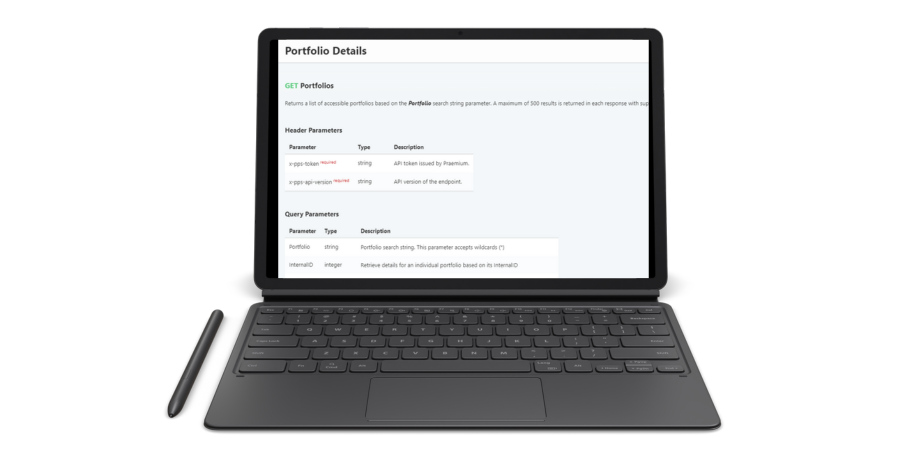

Open integration with other solutions

With the Praemium API Development Hub, you have the tools you need to integrate systems to further unify client experiences or leverage data in the way you choose.

Look at the API documentation site to get an idea of how our API can work for you.

Powerful double entry transaction matching

Praemium facilitates thousands of broker and bank feeds that keep your portfolios up to date every day without you lifting a finger. But even with full integration, we provide further peace-of-mind that your clients’ portfolios are up to date and accurate.

Praemium’s transaction matching tool will automatically match your non-custodial bank and broker transactions. It is our form of automated double entry bookkeeping, which makes any unmatched transactions immediately noticeable and easy to action.

And of course, this can be further simplified with the use of Praemium’s Scope + administration service.

Your data is always your data

With Praemium’s Integration Centre, we give you access to your portfolio’s underlying data.

Cash, income and trade data, all carefully uploaded and reconciled each day via data integration into your client portfolios, can be securely exported to virtually any other common adviser technology platform, such as XPLAN, XERO, CLASS, BGL and many more.

Talk to us about the software you are using and how Praemium can help improve your tech stack.

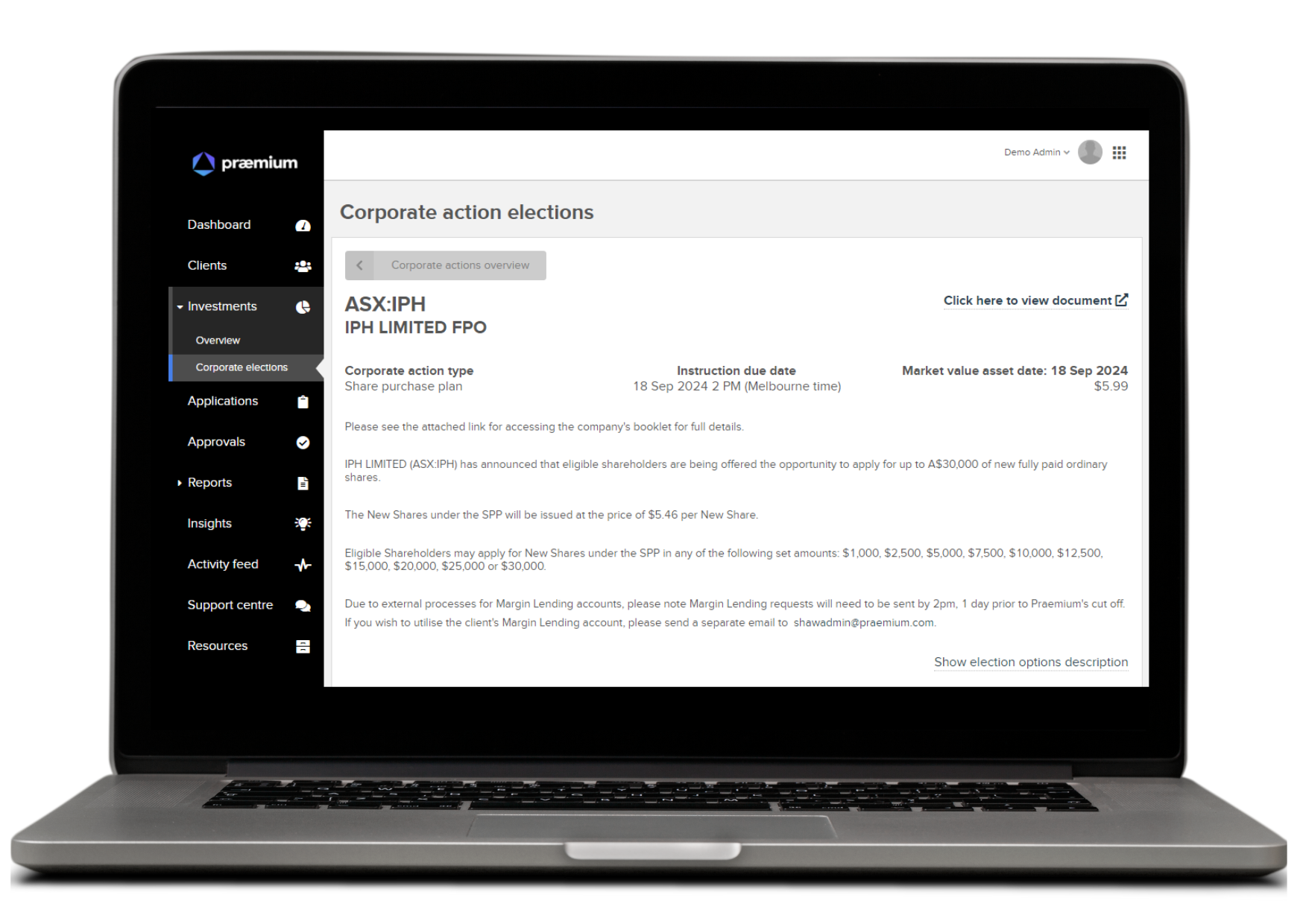

Corporation actions—Making the difficult easy

Our team ensures fast and accurate application of corporate actions for all ASX-listed and over 4,000 internationally listed securities. The Praemium platform recalculates portfolios daily to ensure the portfolio is up to date as quickly as possible.

Praemium offers our advisers the comfort of knowing that portfolios are accurate at all times, even when navigating product rulings that traditional platforms struggle to process. When others are still struggling with complex corporate actions, our team has already double-checked, signed off and moved on.

Our corporate actions expertise and database dating back to 1985 across thousands of listed securities, means we can deliver accurate tax and performance reporting at any time, minimising the impact of product rulings and ensuring our clients have access to historic reporting at any time.

The Praemium advantage in data integrations

Why advisers choose Praemium for data integrations:

- Institutional-grade security — Every integration is built with award-winning data protection, ensuring client assets and sensitive information are safeguarded. By combining advanced encryption with seamless connectivity, advisers can trust their integrated systems to remain secure while still accessible when needed.

- Scalable portfolio solutions — Praemium’s integration capability adapts as practices grow. From individual investors to complex family offices, advisers can rely on a platform that supports changing structures and requirements, making it easier to manage portfolios across multiple asset classes without disruption. This scalability makes investment portfolio integration a practical choice for firms seeking growth without compromising accuracy.

- Cutting-edge innovation — Proprietary technology powers more than just efficiency. Our integration tools improve compliance, streamline reconciliation and unlock performance insights, giving advisers the flexibility to manage complex portfolios with confidence.

Unlock smarter investing with integrated portfolio management by Praemium

Take control of your data and achieve more with Praemium's seamless portfolio integrations designed for today’s advisers. Make informed decisions with confidence using Praemium’s award-winning data integrations empowering advisers with accurate, reliable data. Get in touch today to explore how Praemium can help you create a smarter investment experience.